In recent days, Rob McNealy shared a five-part series on crypto currencies here. I read them, enjoyed them, and found them pretty much spot-on from my own experiences. I haven’t founded a cryptocurrency and have no particular dog in the fight, so here’s the take of a relative novice layperson with almost a year’s experience in the crypto universe.

Yes, my name is John and I enjoy trading crypto. I’d describe it as a constant roller coaster ride of thrills, loops and gut-wrenching drops…including the one we’re in right now as I write this.

I know many of our TTAG readers have more knowledge about their favorite guns than they do about crypto. Rob also noted, correctly, that folks sometimes fear things they don’t understand.

Rob also made a strong case for gun shops to begin accepting crypto payments, just as they accept credit cards. What’s more, he talked about how crypto offers some advantages for both gun shops and consumers who value their privacy. After all, big banks, big government, big journalism, and big politics don’t have a lot of love for gun owners, gun rights…or gun sales.

While you may not own this newfangle “money” today, you may want to start soon. Think of going back in time to the late 1980s or early 1990s and asking yourself why you would want to mess around with the Internet or a “smart phone.” Today both are ubiquitous and essential in our world.

Yes, “crypto” is relatively new. However, its capitalization has grown to $2.5 trillion (with a “T”) over the last dozen years. Its astounding growth shows a lot in common with the early growth of internet and smart phones in the 1990s. Young people embraced both of those back then and now they’re doing the same with cryptocurrencies.

I will share some of what I’ve learned (sometimes the hard way) so if/when you decide to dabble, you’ll avoid some common pitfalls.

Legal disclaimer: the following is not meant as financial advice.

Why Crypto?

In theory, cryptocurrencies make it easy to transfer funds directly between two parties anywhere in the world without going through a bank and paying steep transfer fees. Hence gun stores can accept crypto payments and bypass steep transaction fees, banks that blacklist stores, or credit card companies that discriminate against firearm retailers.

Yes, crypto has critics aplenty. Some pan this “new kid on the block” because they don’t understand how it works. Others trash-talk it because doesn’t make them any money on commissions. After all, you don’t need need a broker or pay big premiums to buy crypto online.

The returns speak for themselves. In 2021, Bitcoin rose 69%. Ethereum went up 328%. That will keep you in ammo, even at $1 per round.

Meanwhile, the S&P 500 was up 26% for the year. Remember all those endless radio commercials pitching you what a great time it was to invest in gold as an inflation hedge? Gold declined 3% in 2021.

Speaking of inflation, if you believe the government’s claims early in 2021 that inflation was 1% or 2% and just transitory, I’ve got some 9mm ammo to sell you at ten cents per round. All you’ll need is a certain DeLorean equipped with a flux capacitor to get it.

Getting started

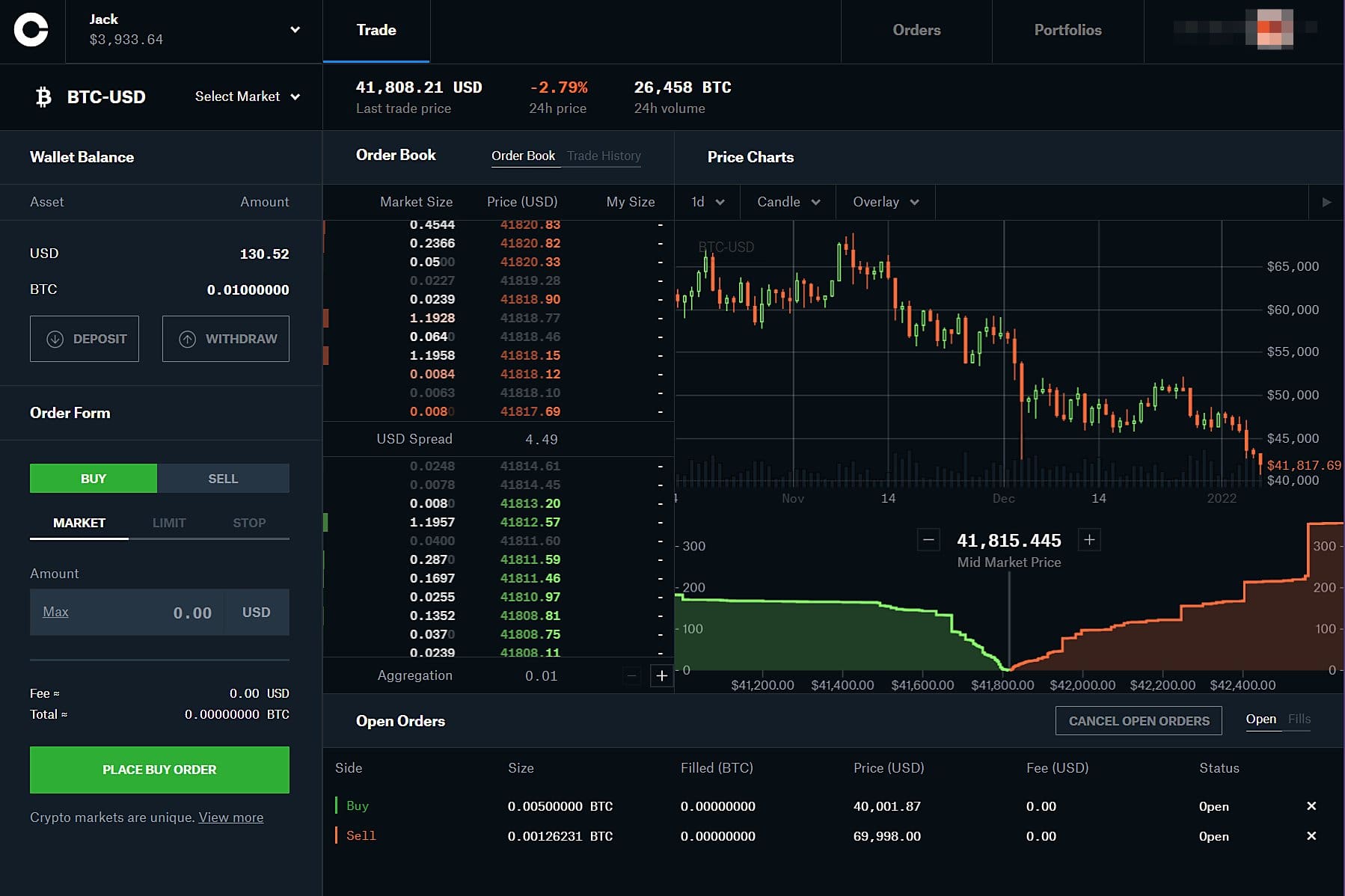

There are a number of online platforms for trading crypto. I looked at a few and liked the Coinbase exchange for its simplicity initially. Within a month or so, I migrated to its sister site, Coinbase Pro, which has more tools (like computer-driven limit buying and selling, more on those in a moment) and Coinbase Pro’s transaction fees are substantially lower than regular Coinbase’s.

You may find a better platform. Great. Just make sure it’s one of the bigger ones and that it has no history of security breaches. After all, you don’t want to lose five or six figures to a hacker.

Once you submit your “know your customer” personal information (just like opening a bank account), you’ll link your trading exchange (like Coinbase) to your bank account. This will take a day or three.

Uneasy with allowing them access to your bank account? I was. Instead of giving them access to the family finances, I opened a new, dedicated account just for crypto funds. This insulates your household finances from any unauthorized withdrawals.

Regardless of the exchange you sign up to use, enable two-factor authentication. That’s where the exchange (in my case, Coinbase) sends a code via text message to your phone as part of the initial login process and before it will execute a transfer of funds out of the exchange. Yes, it’s an inconvenient additional step, but you want to keep your portfolio secure.

An even stronger two-factor authentication process requires the use of Google’s Authenticator which uses a one-time, time-based algorithm. I highly recommend it.

Personally, I run Authenticator on a pair of devices I store in my gun safe so even if someone stole my phone or computer and somehow managed to break the very strong password, they still couldn’t transfer my funds out of Coinbase.

Once the bank link is set up and verified, you will electronically debit your trading bank account to make deposits onto the trading platform. Then it’s off to the races.

Keep in mind that virtually every transaction you make out of or between coins will have to be reported to the IRS. Of course, you only pay taxes on net profits (and you get to write off losses). Also and emphatically…don’t blow off the reporting requirements. Joe Biden’s IRS hired thousands of new auditors specifically for crypto investigations.

At the same time, don’t be intimidated by the IRS reporting. Instead, consider the use of a website like Cointracker.io to handle the tax reporting. For a modest fee of about $100 or so, they’ll compile the relevant data and provide the forms and info you can give to your accountant to accurately report your gains (along with relevant losses and expenses) at tax time.

What next? Some platforms like eToro allow you to “practice” day trading with virtual currency. Instead of using pretend money, I started by buying $100 in six coins (Bitcoin, Ethereum, Algorand, Aave, Stellar Lumens and Chainlink).

Back in February 2021, I started in crypto instead of taking a trip to the gambling boat. I then watched that first $600 I “spent” grow into $630 – a 5% return – in a couple of days. That excited me, so I poured in more “capital.”

I thought I had the world by the tail. LOL.

Then the market corrected. My 5% gain turned into -12% over a few days. Then after another week, I gained it all back and then some, only to experience a bigger correction in April. That one hurt, but soon came a surge that felt like a tsunami that put me back in the green. And then a bigger correction hit.

After my first 9½-week fling with crypto, I was up about 9.1%. Not great, but not terrible to quote a certain Soviet engineer from Chernobyl. Especially after some silly mistakes, including foolishly buying at near all-time highs, missed opportunities, and a fat-fingered trade.

At the same time, I can remember not so many years ago when an 8% annual return on mutual funds seemed impressive.

Keep in mind that Bitcoin and Ethereum are the “big dogs” in terms of market capitalization. The other coins are known as “alt” coins in polite company. While Bitcoin and Ethereum can show volatility, some of the smaller altcoins can exhibit break-neck changes or even collapse. Ten to twenty percent volatility in a day are normal for at least a few coins each day. Or 50%. Or more, sometimes in minutes, not hours.

Translation: don’t panic. They don’t call it, “Hold on for dear life” (HODL) for nothing.

Rule of thumb: the smaller the capitalization of a coin, the greater its potential volatility.

No matter if you’re a gun shop looking to get into crypto for retail transactions or a regular person wanting to buy in for fun or to buy a gun from a shop that accepts this new “currency,” I sincerely hope you do even better than I have. If you follow the suggestions below, you should have a good shot at avoiding some common mistakes.

The Seven Golden Rules of Crypto

1. Use two-factor authentication for your account. If you don’t use two-factor authentication, you risk a lot on a one lone password. Especially if it’s a weak password.

2. Only invest what you can lose. Don’t “invest” your mortgage payment. Don’t take out loans to buy crypto.

3. Diversify. Don’t put all of your crypto in a single “coin.” Most long-term investors have Bitcoin and Ethereum in their portfolio, with those two representing about 30-50% of their holdings. I’m more of a day trader. Bitcoin and Ethereum represent less than 20% of my holdings. Currently Filecoin and Chainlink are my two largest holdings, but those change over time. Not so long ago, Solana and Cosmos filled those spots until I sold the bulk of them taking profits.

4. Avoid FOMO – fear of missing out – at all costs. It usually happens when you see a coin rocketing upward in value and you feel like you need to invest right effin’ now to avoid missing the rocket ship ride to the moon. Or, alternatively, you see a coin falling in value and feel obligated to dump your stake before it crashes further. Either scenario almost universally ends poorly. (Additionally, see Rule #7)

5. Bitcoin and Ethereum are the big dogs for a reason. While many “alt” coins will come and go over the years, these two will almost certainly remain for the long-term investor. Even if there’s a correction, they’ll come back handsomely and then some if history is any indicator.

6. Buy the dip, dummy. And the corollary: Never buy at the all-time-high (ATH) or within 15% of one. Look for a promising coin that’s suffered a significant dip of 40-60% (perhaps because of a huge market correction). That’s the one to buy. Repeat after me: Never buy at an all-time high.

Minor sell-offs happen usually at least once or twice a month. Big corrections happen a couple of times a year. Think of the corrections as big “sales” on the coins you want to buy.

7. Patience is usually handsomely rewarded.

Again: life is hard enough. It’s harder if you’re stupid. Or do stupid things like failing to use good, two-factor authentication of your login credentials. Don’t invest your mortgage payment or fail to diversify. And don’t buy coins at an all-time-high because you fear you’re missing out on a hot prospect.

The Helpful Hints

- Always watch Bitcoin. As the big dog of cryptocurrencies, Bitcoin calls the tune. If Bitcoin’s doing well, most of the altcoins usually follow, sometimes within seconds. The inverse also applies.

-

Don’t be greedy. If you’re trading in the short term, don’t miss partially cashing in a 25% or 50% return over a day, week or month in fear of missing out on a 500% return. Nobody ever went bankrupt taking profits. Opportunities for huge returns will generally be very limited for short term investing. There’s nothing shameful about cashing in some or all of a modest 50% return after holding a coin for a few weeks.

-

Don’t get married to any one crypto currency outside of Bitcoin and Ethereum. Just because “Coin X” did well for you earlier in the year doesn’t mean it will continue to offer great returns. Watch the news and pay attention. Be prepared to liquidate some or all of any position outside of Bitcoin and Ethereum if you see obvious reasons to do so. Similarly, just because a particular coin hasn’t performed as well as you would like is NOT a reason to liquidate. Remember: Patience is usually handsomely rewarded. In the lingo of crypto, HODL (“hold on for dear life”). Especially for Bitcoin and Ethereum.

4. Let the computers watch the market for you. Let them do your buying and selling. Here’s how it works: After you have purchased a position, place orders (sometimes called limit orders) on your trading platform to have the computer take profits should the coin value spike sharply as many of these coins often do for seemingly little or no apparent reason.

I have a couple hundred of these sell orders running in the background. Generally, I structure them to execute a certain percentage holding (say 10% at each limit sale order) incrementally from a 50% profit to 500% profit. So if an obscure coin spikes out of the blue for a short time, my limit orders to sell will execute and allow me to grab a nice bonus while I’m living life elsewhere.

As an example, one morning I took my boys to daycare and when I returned home a half-hour later, I had $11,000 waiting for me from unexpected (but very welcome) profit-taking sales. Yeah, that was admittedly a truly exceptional day. Grabbing some profits at the highs locks in your profits, of course.

5. I recommend holding back a significant percentage (say 50%) of your capital in “cash” after profit-taking. Then find coins you think have good potential for growth and place buy orders for prices just above their lowest traded price from the past six months to a year. This way, if the market has a “black swan event” (such as happened in May 2021), you lock in some great sale prices. These will pay off handsomely when the coin’s price normalizes and then later appreciates with the normal ebb and flow of the markets.

For me, I look for coins that have, at a minimum, traded at double or better yet triple their current price (or my desired “limit buy” price) within the last twelve months. That way if Ethereum, for example, crashes from its current $4000ish per coin to $2000 for a short time (sometimes only seconds or minutes), a purchase order will execute without me babysitting the markets to watch for a great sale price.

At this writing, I like Filecoin, Chainlink and Balancer in particular for coins with great 200-300+% growth potential over the next few months. Your mileage may vary.

Also, by placing limit orders to buy and sell, you will position yourself to win no matter if the market surges or corrects. The only way you lose in that scenario is if the market consolidates and prices remain stable… and that seldom happens in cypto.

What has all of my trading earned me? Well, the learning curve has proven expensive, but I’m up about 40% as of this writing and my boys each now have about $4000 in crypto in their accounts, each started purely through my primary account profits. I remain a long way from buying a Lamborghini. But profit-taking has paid for a rifle, a thermal scope, a hobby solar power set-up, and a lot of buys of other coins.

Go ahead. Dip your toes into the water of the crypto pool and try some trading, even if it’s only a couple hundred bucks. With the big correction we’ve had since the first of the year, it’s a good time to buy. Besides, crypto trading remains about the most fun you can have with your clothes on that doesn’t involve pew pew pew, or unethical, immoral, or fattening endeavors.

Cash. Thank you very much.

Cash first and foremost.

Stay out of unnecessary debt. Sleep well at night.

Have a few months’ worth of supplies and funds permanently set aside to buffer you from the effects of any black swan event that will rock everyone else’s boats.

Invest with any extra money above and beyond this, and remember that the most important rule of investing is the return of of your money before any return on it. Pigs get greedy, but hogs get slaughtered.

Keep the bulk of your investment funds in reasonably vehicles. Set aside a dedicated portion for more speculative pursuits, and be prepared to survive if for any reason those funds are completely lost.

Sounds like a primer for investing in ‘penny stocks’

This is exactly what it is.

And if you think the big boys on Wall Street aren’t manipulating this unregulated market, you’re a fool.

Nobody, and I mean nobody, uses crypto for legit payments. The solution cannot grow to that purpose. Bitcoin alone currently uses seven times the electricity Google does globally. There is no scaling here – it’s just a risky place to put actual usable money where it can’t be used.

And once more for the folks in the back: your crypto transaction is digitally etched into the coins you held for as long as the platform exists. So if you want to have a transaction you don’t want someone to know about, it’s still cash or metal.

Remember at all times: if it’s on the internet, it’s not yours.

“…your crypto transaction is digitally etched into the coins you held for as long as the platform exists. So if you want to have a transaction you don’t want someone to know about, it’s still cash or metal.”

As I understand it, there are places where crypto can be exchanged directly for cash or metal. And vice-versa. Places like public parks in major cities.

If you wander down there with folding money, you can buy coins or partial coins face-to-face from a ‘broker’ of sorts who collects a percentage ‘off the top’ of the transaction.

Then, the reverse is done when the coin you bought is converted back into cash that he places in your hand. It isn’t cheap, but it is a way for you to clear customs without having to declare large amounts of money.

Once you have a coin (an alpha-numeric ‘string’ of sorts I’m assuming) you can securely encrypt it (PGP, pretty good privacy) and safely park it online somewhere, (like a g-mail web mail account folder for your draft emails) and then clear customs and then find an internet cafe to retrieve it at your convenience. Yeah, you’re gonna pay for that as a percentage, but it seems to me that could reasonably make someone anonymous that way. I believe Al-Qaeda used that method to finance the 9-11 terrorists…

Yikes! Right up there with “use a fanny pack to CC” before ILLannoy had legal carry. I’ll pass on cypNO…

In theory a good idea, in practice you don’t transfer your coin to another person. You wire money from your bank account to your crypto platform, they transfer it to another one of their accounts, another person then sells it for cash. And the best thing, on the blockchain not a single transfer occurred, as neither of you really owned a wallet. You just trusted the exchange to have said coin in their wallet. Only a true wallet2wallet transaction would be without a middle man, and even then you both had to already have and hold on to your coins afterwards, not exchange them for bank account dollars.

So in practice, cash is your best and easiest way to buy shit anonymously.

“I started in crypto instead of taking a trip to the gambling boat.”

And that sums it up right there.

If you are of the type personality that gets their juice from the whimsy of Fortuna’s Wheel haphazardly pointing your way, then crypto was made for you. But in reality it’s intrinsically even less “fair” than true chance- crypto is merely a digital slot machine.

So if you’re a “serious” gambler, then you might seriously enjoy crypto. There’s something out there for everybody…

Never trust anyone who promotes one gambling scheme over another gambling scheme.

When shtf which will buy you more potato’s, a crypto or physical gold and silver?

Lead and copper trounce them all.

Goldbugs and coiners hate to hear it but PMs and crypto are both hedge. SHTF, you want bullets.

Just ask Selco where gold and silver get you in a true SHTF situation.

I have bullets. But in a collapse gold and silver will still have some value. It would have to be a total end of the world scenario for that not to be true.

Bullets only get you so far. Are you in a small town? Or a big metro area? Are you one man or a group?

I’m a senior. You are not. But you have real health issues. Do you require the modern support system that will vanish when the power is switched off long term?

Selco’s experience is his. Ours may be entirely different.

“Lead and copper trounce them all.”

To a point. You can’t eat metals, and the forests will be stripped bare of game for you to shoot. Source, my grandfather back in the early 70s. The great Depression had a *lot* of people looking for something to literally eat. (Yeah, yeah, your guns could be used to raid someone’s stash, but that’s risky)…

Boch: Avoid the “steep” transfer fees charged by banks.

Also Boch: Use “this” crypto exchange vs. “that” crypto exchange because the fees are substantially less….

Boch again: You convert your bank holdings to crypto, which is transfered to some other crypto dude, whose bank then changes that back to dollors (or francs, or whatever). Seemingly without incurring any bank or crypto fees??

I really tried to understand crypto and perhaps invest in it. But every time I take another look, I see another view of what looks like a big scam for the average guy. How on earth do huge banks of computers, humming away and burning prodigious kilowatts, mine fractions of coins and create value from absolutely nothing?

Vaporware.

@Defens

“How on earth do huge banks of computers, humming away and burning prodigious kilowatts, mine fractions of coins and create value from absolutely nothing?”

see, nothing up my sleeve …now I just say the magic words – AlaKaZam …. and… Poof …crypto ‘coin’ ’cause I say so.

That’s how

“awaiting moderation “. WTH?

So true. I understand investing in a tangible good, or in a company that provides tangible goods or services. None of the many crypto articles has even begun / attempted to explain what crypto does to profit or grow.

Crypto is like buying an empty sterile plastic specimen jar. Except with crypto you’re only buying what’s INSIDE the empty sterile plastic specimen jar- you aren’t getting the container itself.

A specimen jar has actual value because it physically exists and can be used for many things- it can even be melted down and repurposed into something completely different. The empty inside the specimen jar.. THAT’S precisely how much crypto is worth.

But, to each their own.

Well said!

“Seemingly without incurring any bank or crypto fees??”

They charge.

But with a guy in a public park with crypto, you can negotiate that fee…

as i keep saying, if Crypto had any inherent value, Bezos would turn the thousands of idle AWS machines on it for a few minutes and corner the market…

LOL crypto currency.

Invest in turnips, seriously, the powers that be can turn off your Crypto’s any time they want, and I’ll still be fat eating boiled turnips.

Rules 1-7 are the same for Vegas. Idiots however built Vegas by BEING idiots 1. by participating in stupid 2. you violating Boch rules 1-7 while participating in stupid

And next week, we’ll be getting a pitch on NFTs. What is this garbage doing on this site?

The best way for everybody to invest in crypto is for everybody to give me their money so I can travel to a country with no extradition treaty and invest it for them.

Cash only.

Honestly, at this point crypto direct for guns as a payment scheme sounds good but the SEC will be on that shit like white on rice. Guns AND crypto… Jesus, are you some sort of insurrectionist? You don’t trust the almighty dollah!?

[Full disclosure, no I don’t trust the dollar. At all. Cash is trash because the dollar is garbage. As succinctly as I can put it, ahem “Fuck fiat” is my personal opinion. But then, everything’s denominated in fiat so… lol. Crypto sure scares the shit out of Erdogan though and that’s a good thing so it’s not all bad.]

I’m not going to get deep in the weeds here because I’m loath a fuck to get into the coiner/nocoiner argument but I’ll point out a few things.

1. Blockchain ledgers are public, probably something to consider. For private transactions it doesn’t much matter I guess but .0476BTC to Bob’s Guns is a pretty damn obvious thing to see on the ledger if you know Bob’s address and Bob would have that publicly available so he can get paid, especially if he does any online business.

2. If you possess gaming rig(s) you can mine cryptos at a pretty health profit if you’re doing things right. $2-3K/year is easily doable without a dedicated mining rig. Less a few hundred for the power costs.

3. Realistically, yeah, BTC and ETH are both moving towards wider acceptance as methods of payment. We’ll see what happens. Some of that will have to do with other placeholder coins for transactions and which network handles them better. As of now the number of places you can legitimately use cryptos directly are relatively small but growing. You can however, quite legally, turn cypto directly into gold and silver if you like. Apmex, for example, does bullion deals and takes crypto direct. They currently accept nine different cryptos.

That said, implementation for something like firearms is going to be tricky. You’ll have to wait for the big investing houses to get into cryptos in a larger way than they are to make the SEC comfortable enough that they won’t see crypto for guns as some sort of really, really scary necessity for a fainting couch.

Let’s be real about what crypto is and is not at this point in time.

Crypto is an investment and a hedge that’s what it is. But like futures it’s a game where you can lose your shirt fast. Though not as quick as playing shorts in the current market as a small fry, lol.

Currently, crypto not a good store of value because vol and it’s not a great method of trade end to end at this point either without getting bent over on transaction costs. The later will probably come in the future but there’s going to be a TON of pushback from governments on this because, well, if we’re honest, the fiat system is totally screwed and imploding and those issues will accelerate if people run away from fiat faster than they already are.

@strych9

“… the fiat system is totally screwed and imploding and those issues will accelerate if people run away from fiat faster than they already are.”

“people” and the “they” have been saying that since before the United States became the United States by declaration and the Revolutionary War. Fiat currency is still here.

The fist “American” ‘minted’ fiat happened when in 1652 John Hull was authorized by the Massachusetts colonial legislature (while still a British colony) to make the earliest coinage of the colony, the willow, the oak, and the pine tree shilling in 1652. The very first thing said of the new money was ‘this currency will fail, my (…as in another) currency is better’, and as different currencies started appearing the first money scams in America were born and continue to this day. And ever since then “people” and the “they” have been basically predicting “…the fiat system is totally screwed and imploding and those issues will accelerate if people run away from fiat faster than they already are.”

“The fist “American” ‘minted’ fiat …”

should have been “”The first “American” ‘minted’ fiat …”

sorry ’bout that

The only way you can think shit’s not going to get out of control is if “M2” is nothing but a weapon’s platform to you. If it’s not and you look at the history of interest rates you know that “fucked” is putting it gently.

And it’s not just the dollar. China’s got a $62 Trillion problem. The EU’s a shitshow, the Lira, oof. The real virus has always been monetary and the contagion spread long ago via the vector of leverage.

But what do I know? I’m sure ammo prices will be back to normal by summer, Joe’s gonna fix the supply chains for everything from semis to food and Kazakhs are going to be making up and singing kumbaya in a few days too, probably while getting hammered with Russian paratroopers.

you can make up anything you want. But the fact is that for literally hundreds of years “people” and the “they” have been basically predicting “…the fiat system is totally screwed and imploding and those issues will accelerate if people run away from fiat faster than they already are” yet the fiat is still here.

That exact argument can be made about Mt. Vesuvius on August 23 79AD.

A day or so later it’s not a great argument.

Sorry, the math is inescapable on this. You raise interest rates to beat back the real inflation (currently running at 15%+ YoY) just like 1980 and your service on the National Debt goes to $5+ tillion in a year. Now you have print money to cover the interest payments.

Or you just stay on this path and it’s a bit slower.

Either way, you’re looking at a revaluation like Argentina. Dollar 2.0. It can be no other way. Except this time they’re going to want that to be “cashless” and that’s the complete and utter end of your freedoms.

This ain’t 1980 with a $900B debt on $3T economy with a tailwind. It’s 2022, with $29T debt on a $21T economy with massive headwinds that are getting worse and a fundamentally unsound basis along with another $100T in unfunded liabilities.

But again, what do I know? They governments only spell this out for you.

Oh, and that’s all stacked on top of the end of a pandemic which, historically, creates mass unrest 47/52 times in a country where the term “civil war” is being bandied about by major publications on both sides of the aisle.

and like I said you can make up any thing you want like you are doing now, but the fact remains that for literally hundreds of years “people” and the “they” have been basically predicting “…the fiat system is totally screwed and imploding and those issues will accelerate if people run away from fiat faster than they already are” yet the fiat is still here.

Since you are stretching and over dramatizing things a bit like paranoid people tend to do – Nostradamus predicted the end of the world in almost every year since he first predicted if you look back and look at all the interpretations of ‘signs’. And once again for 2021 and for 2022 with the added bonus now that in 2021 we would have a Zombie apocalypse after a Russian scientist created a biological weapon-virus that can turn people into zombies.

Once again, despite you making up all the things you want and trying to tie together various events from, weirdly, Mt. Vesuvius on August 23 79AD to the current day pandemic, it doesn’t really mean any thing until it comes about. People have been doing it for thousands of years with various things and in the U.S. hundreds of years with fiat currency yet the fiat is still here.

In 1998, a computer scientist named Nick Szabo proposed the creation of a digital currency. At the time, Szabo named this currency “BitGold.” He predicted, indirectly, the fail of fiat in a decade and cited just about everything ‘financial’ you do now (without the more ridiculous and pandemic). In 2009 BitCoin was created, almost immediately one of the justifications for it from its promoters and adopters was, basically, ‘fiat is gonna fail soon’ citing in their supposedly expert analysis all the things you do now (without the more ridiculous and pandemic).

The fist “American” ‘minted’ fiat happened when in 1652 John Hull was authorized by the Massachusetts colonial legislature (while still a British colony) to make the earliest coinage of the colony, the willow, the oak, and the pine tree shilling in 1652. The very first thing said of the new money was ‘this currency will fail, my (…as in another) currency is better’.

Yet with all this “expert analysis”, and predictions over the years, and volcano eruptions, and pandemics, and rise and fall of empires, and replacement of fiat currencies with other fiat currencies, and national debts, and inflation, and wrecked economies, and disasters, and wars, to modern day with all the internet and cryptocurrency ‘wizards’ of today promoting cryptocurrency as hard as they can, tying all sorts of things and events together, citing a seemingly never ending ‘imminent’ failure of a ‘fiat’ system of currency (and if you go father back over thousands of years) – despite the eruption of Mt. Vesuvius on August 23 79AD, a ‘fiat’ currency is still here and viable.

“Except this time they’re going to want that to be “cashless” and that’s the complete and utter end of your freedoms.”

If it truly looks like that will happen, more than a few states will say ‘fuck that noise’ and file for national divorce.

Both sides will be grievously hurt. But only one of them will have the food and energy, and likely the nuclear warheads. Good thing the Leftist Scum trained their side to be frozen in fear at the very sight of a firearm or nuke… 🙂

So are you guys just a full on gambling site now? Must have a sponsor deep into the crypto pyramid

This site’s purpose is to destroy its’ readers’ brains.

First it tells you to support incarcerated for the McMichaels, who were the victims of a schizophrenic violent criminal.

Now it has a literal slip and fall consultant telling you to buy sh1tcoins and speculate. (Seriously, look up this unemployed clown).

Finally- I don’t forget when JWT admitted to taking money from the Israeli government. LOL that happened.

Bonus: Kat Ainsworth telling you it’s ok to kill your husband if he asks you to lose weight.

So you blame this site for your brain troubles?

Electronic money, sorry but the market crash of 1929 was bad enough. I obviously was not alive then, however I can read and this was catastrophic for the nation and the world. Electronic money based on nothing just does not work for me. Like buying Gold from a company that say’s they will hold it for you, Bad idea.

Kind of like a prepper who does not include firearms/ammo in their prepping, Prepping without firearms, well you are prepping for someone else.

Funny, cash is really simple, never worried about a cash transaction.

Funny how every government on the planet wants to move to blockchain that they control. What do you think that digidollar is about? A cashless society. They aim to impose this on you and tie it to a digital ID. Full control like Stalin couldn’t begin to imagine.

That’s no conspiracy theory. They tell you this. All the time. They’re already rolling this stuff out.

It’s not in the paper, it’s on the wall.

How much are you being paid to shill for cryptos?

If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.

LoL 😂 a pseudonymous ‘Satoshi Nakamoto’ for a pseudonymous ‘Satoshi Nakamoto’

Sounds a little like trading tulip futures to me, although, for me, returns are still out about precious metals backed cryptos.

I spent enough years in Silicon Valley and working on designing systems with computers, large software systems, networks, and the whole security apparatus to appreciate the simplicity of gold/silver bullion and cash.

Here’s the problem with crypto: Not everyone is as smart or computer-savvy as you are. Some of those people might have guns they want to sell. When I walk up on a guy who is in his 80’s and is selling off his collection because his kids don’t want or appreciate what he has, and he knows his wife will do something less than impressive with his collection, I bring cash. Not checks, not crypto, not a credit card. Cash.

The best part of cash is the psychological aspect. When I’ve been at a gun show or meet-up and I’m haggling over the price of a gun, whipping out a pile of bills and saying things like “This is $800 right here.” He wants $1000. I say “OK, thanks for your time…” and I walk away. Not mad, not huffy – always polite about it.

Half of the time, in a minute or two and a few yards away, I have a tap on my shoulder. “I’ve thought about your offer… sold.”

Can’t do that with crypto and computers.

I’ve done that too … “hey, I’ll give you $800.00 for it” (or what ever I offer) and whip out the cash, the say “nope” I say “ok, thanks for your time” and walk away. And like you say, about half the time they snag you before you get too far away and go “$800.00, ok then.”

All I take to gun shows and personal sales is cash.

I don’t think Boch’s suggesting it as the only method of payment, I read him as suggesting that it be added to a gun store’s list of options.

Personally I think that would kick the regulatory state into overdrive going after the FFL but, that’s just me.

Boch’s argument here is, IMHO, both small and large. He’s suggesting breaking away from government control via crypto as a macro idea and suggesting gun stores could help with that in the micro.

Personally, I’m agnostic on the idea for a variety of reasons but I see where he’s going with it. Yeah a personal sale with a 80 year old isn’t gonna be in ETH or BTC or whatever but that’s a case-by-case thing just like the gun stores idea.

The overarching ideas behind decentralization are ones the 2A community should consider in terms of both strengths and weaknesses for the gun community going forward because the current government trend is towards technocratic centralization on literally everything. Realistically I doubt that happens because of the coiner/no-coiner rage that goes on. And, honestly, a fundamental lack of understanding from most people on how hedges, investments, currencies and other instruments actually function in various theoretical future circumstances.

UUUUH PAY WITH CREDIT CARD AND EARN POINTS ..

EACH TO THEIR OWN

Pay with cash and you dont need points.

Pay with a credit card and maybe you can pay someone to show you where the ‘CAPS LOCK’ key is at.

pretty much everyone charges for credit card transactions.

Most of the processing companies are anti-2A at this point.

I offer free shipping to anyone who pays on Gunbroker with Bitcoin.

No record, completely anonymous.

How many bars of gold pressed latinum can I get for 16 Crypto’s?

The gambling aspect is fine for a high risk investor, but it’s a foolish way to run a business. The volatility ruins its reliability as an item of exchange.. If I take Crypto XYZ in exchange for real merchandise, I need to get an equivalent amount of dollars out if it so I can buy new inventory, or transfer it to a supplier who takes Crypto XYZ for merchandise. If the crypto I was paid drops 25% before I can cash it in, I’ve probably lost money. Cashing it in immediately has transaction costs. Cash would be preferred — no fees, no traceability. There’s no connection or predictability to crypto. Why did Bitcoin drop 25% in the last month? It wasn’t linked to anything that happened in the real world — nobody announced a cheaper/faster way to mine, etc. Some say it’ll go down to $10k, other up to $100k. John talks about cryptos that have gone up, but he doesn’t mention the ones that have disappeared, leaving the owners with nothing other than a tax write off.

I am all for cash but you guys do realize that all money is funny money right? Yes, crypto is too but so is everything else. Most “cash” is just numbers on a computer screen and not hard currency. You can’t do anything with it except trade it. While gold and silver do have a few practical (usually scientific) uses their utility is they are shiny and humans are like crows.

I do not get the anti-crypto sentiment here.

Here’s the anti-crypto perspective I have. I’m a retired EE. I know that when (not if) the fecal matter hits the fan blades, and the grid goes down, there’s damn few people out there who can get it restarted. Everyone thinks electricity looks easy – until they try to do it at a large scale, and suddenly they discover what us EE’s already know: It isn’t as easy as it looks. The more “renewable” ephemeral energy we add to the grid, the less stable it will become. The more electric cars the elites are pushing for, the more unstable the grid will become. In 10 years, you’re going to be looking at regular power outages in this country – more of them like last winter in Texas.

When the grid goes down, I want something I can place on the table that the guy on the other side of the counter (who also doesn’t have power) looks at and says “OK, I’ll sell (insert name of good or service here).” That something is money people can lay their hands on, touch, feel, etc. Actual folding money and bullion or bullion coins fill that function.

“I’m a retired EE. I know that when (not if) the fecal matter hits the fan blades, and the grid goes down, there’s damn few people out there who can get it restarted.”

If it truly goes that sideways, the people where you live could disconnect from the national grid and go probably wind alone and watch the coasts go dark.

I find it more than a bit amusing those Leftists think the rural areas will completely collapse without their ‘help’.

At least the price of beef will become vastly cheaper in flyover… 🙂

Global ATM Hacking Service are the best professionals hacking blank card team, I got my card from them, they are trusted and reliable, I saw many people giving comments about them and i gave a try and it worked for me, I so much like their technology, they can grab bank card data which include the track 1 and track 2 with the card pin which can be used to withdraw at the ATM or swipe at stores and POS. To order, you can contact them via Email: [email protected]

WhatsApp:+17027487593

The topic of using cryptocurrencies is becoming more and more popular, and not without reason – the more payment options for clients an entrepreneur provides, the more profitable it is for him. After all, it is possible to attract a new target audience who, for various reasons, prefer to pay only in digital currency, as well as to increase conversion to payment. Usually payment is made automatically after several confirmations of the network within 10-20 minutes. Depending on the service, the buyer will be offered different cryptocurrencies available with which to pay for the order. The background of Crypto Academy among such services right now are Bitcoin, Etherium, Litecoin and Tether (USDT).

Since childhood I loved to do something with my money. My friends and parents always advised me to make money on my favourite hobby. At some age I started doing it, but my income was pretty low and my friends advised me to exchange bitcoins. They threw me on this site https://tabtrader.com/articles/golden-cross-and-death-cross-explained now I have a good income from this. You should also try to use it.

Now sending cryptocurrency has become much easier and faster, and all this thanks to a gorgeous application that you can download on the website https://www.kasta.io/blog/how-to-send-crypto-with-qr-code and read at the same time about how to use the QR code to send cryptocurrency and bitcoins.

What advice would you give to a novice trader? It seems to me that now there are so many different options that it is rather difficult to choose any particular strategy.

As a person who recently went on a journey into the world of cryptocurrencies, I studied various platforms for participating in trading activities. One of these platforms that caught my attention is https://cryptomkt.com/. It seems convenient to use and offers competitive prices. However, I didn’t have a chance to check it myself. I think it might suit you!

Comments are closed.