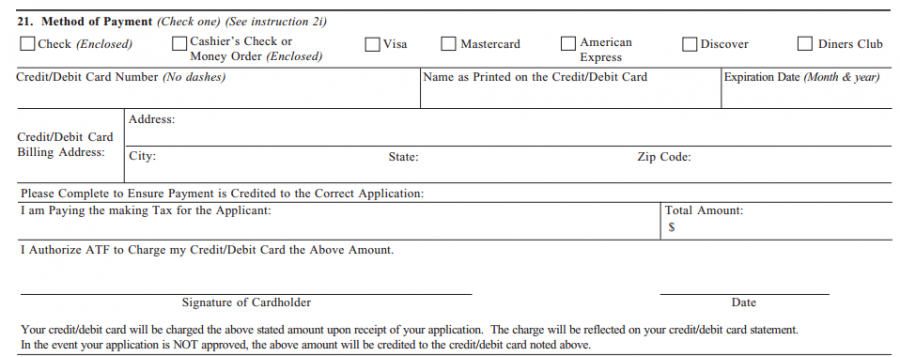

As if you weren’t already giving the ATF too much information on the Form 4 (that’s the application for a tax-paid transfer of an NFA item, like a silencer) or a Form 1 (the application to make and register an NFA item), the ATF has just added a brand new section to the paperwork that allows you to pay by credit card. Previously applicants to the ATF needed to submit their $200 tax fee either with a check or money order when filing using paper copies. But this latest change adds the same ability to put that $200 tax on your AmEx that electronic Form 1 filers have been enjoying for about a year now. The new forms are already available online, and I’ve just used the new Form 4 on a Dead Air Armament Sandman silencer that arrived for me at my FFL. There’s just one wrinkle . . .

“I am paying the making tax for the applicant.” That’s the statement you make when charging your credit card. If you are indeed the applicant then there’s no issues, since you are paying for yourself. But for some gun trust lawyers, the idea that you (an individual) are certifying to be paying the registration fee for a trust or corporation (that is not you, legally speaking) might be a bit of a sticky wicket.

The gun trust lawyer who wrote up the trusts for me, Tyler Kee, and even El Jefe RF doesn’t seem to think that this is an issue: included in his packet of documents is something called a “three way contribution” document, which acknowledges that someone else paid for the registration fee for the trust out of their own pocket yet the item itself belongs to the trust. So, no worries there. Still, consult your local lawyer. As always.

……so now we have to print 2 pages front and back?

We know already that they listen to your phone calls, read your emails, review the web sites you visit and I am certain they can review your AmEx anytime they want, so splitting a hair over paper or plastic seems pointless.

Oh boy…

This just got real dangerous.

-gotta switch pages, I need to check the limit on my sky miles card and find the order page for a silencerco omega.

Isn’t the “I’m paying for the Applicant” just to tie the paying human and paying-human’s credit card to the Applicant, who might not be the credit card holder? I could pay with my credit card, while the Applicant might be my brother, my trust, or my corporation, no?

This doesn’t seem worrisome.

Beware… All of the eForm 1s I’ve submitted (and had rejected) have never been refunded. They keep the money.

Over 3 years worth of submit form 1, get rejected, never get the money back.

What? I’ve cancelled SBR builds after getting the tax stamp and got my refund back, in a timely manner no less. As long as you didn’t build the thing they’ll refund you. Call them up.

I get put on hold forever. Emails ignored.

After they cleared themselves from Operation Checkpoint, of course they will accept bank cards.

Suckers funding their slave masters for overpriced mufflers.

Technically the transfer tax is owed by the maker or seller, not the buyer, but I’ve never known ATF to turn down the money. If there ever is an issue (bounced check?), they will purse payment from the seller. Such a case happened over a half century ago when George Numrich formed Numrich Arms (now Gun Parts Corporation). He discovered that among the quantity of surplus WWII gun parts and accessories he had acquired from other companies was a stash of something like 50 Thompson submachine gun receivers. The Treasury Department demanded tax payment for these receivers ($200 x 50), which was not included in the purchase price he had negotiated with the sellers. In the end it was the sellers who got stuck paying the bill to Uncle Sam. This was pre-ATF so SWAT teams and ninja tactics were not the order of the day. Lawyers, the original ‘hired guns’, handled everything in a more gentlemanly manner. Ah, to return to those halcyon days or yore when The Lone Ranger, Robin Hood, and Mickey Mouse Club ruled the airwaves. Not like now where I feel more like Robin Hood being pursued by the Rangers for all the Mickey Mouse rules I’m accused of violating.

Comments are closed.