Reader Steve writes:

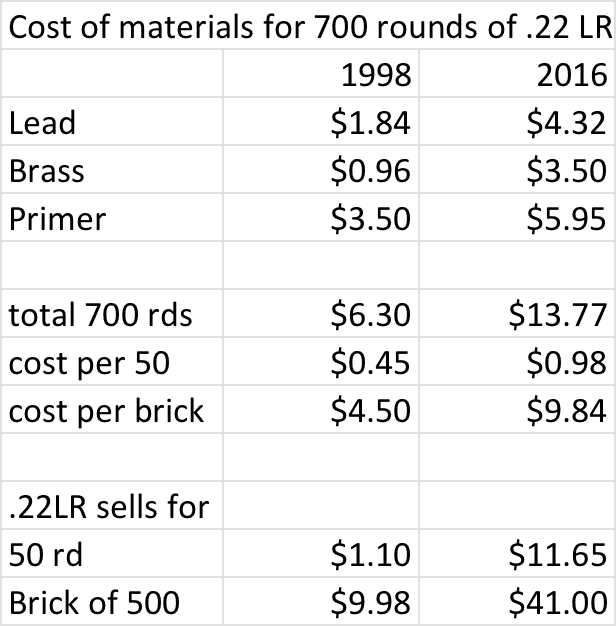

With the price of .22LR being what it is I decided to do some research and compare costs between 1998 and 2016. The above chart lists my costs if I were buying in commercially available small quantities, i.e. pounds vs. tons. Pricing for quantities that manufacturers would buy would of course be significantly lower. Sources for the indicated costs came from sellers on the .net using Google terms like “cost of brass (lead) from 1990 thru present (2016). While it is to be expected that, like everything else, prices of metals go up over the years, this shows that the increase in cost of basic materials isn’t consistent with price of the final product . . .

My numbers don’t take labor or other costs of production into account, just the materials. I used 700 rounds based upon brass case weight of an average .22LR case which averages to about 700 cases per pound of brass. Then I used grade school division/multiplication to determine the cost of 50 and 500 rounds.

The retail prices don’t include taxes/shipping, just a cost comparison of the average cost of materials for both years. Even factoring in inflation and increased labor rates in comparing 1998 to 2016, this doesn’t account for the current price, even figuring in overtime costs. In short, adjusting for inflation, why is .22LR so much more expensive today?

Because it is what the market will bear.

+ 1

Exactly. If prices are too high, relative to the production costs, enterprise risk, interest rates, and myriad other economic principles I can’t cram into a one paragraph post, then all someone has to do is enter the industry themselves and make a zillion dollars.

If it’s oh so easy and manufacturers are making “excess profits”, what economists refer to as “economic profits”, then charge in there, undercut the competition and get rich.

The guy with no job that trolls all the Wal-Mart stores and sells the .22 for triple what he payed. That’s who is making the money!

I hate that guy…

That guy’s customers are just as bad, if they stop paying triple that guy needs to lower his price.

Don’t be “that guy” …

I watched a hipster do that at Cabelas, he showed up late to the morning line, then hung around until they opened the door then he dead sprinted to the .22 ammo. What a schmuck.

There are two of those guys who camp out at the sporting goods counter in my store early every tuesday morning, and wait for the dept. manager to bring out the ammo. They usually bring a few buddies or kin with them, and buy every box of .22 & 5.56 before it even hits the shelf. I then see them fridays at the local flea-market reselling the same ammo for 3x/4x what they paid, usually to OFWGs who refuse to shop at Walmart.

Well that makes sense because the guy selling out of the boot of 94 Corolla has his own supply chain and contracts, licenses etc. so you know Walmart is not getting anything out of the transaction.

Plus all we all know that Walmart ammo is a cheaper version of the same ammo you get in the other stores.

Sure the manufacturer would have to spend tens if not hundreds of thousands of dollars in downtime to reset machines to the Wally setting plus the logistics of keeping the identical boxes separate and the delivery routes all mapped out and all that jazz. But magic so that makes it cheaper.

I propose a set of rules to stop this crap, 3 box limit, 18+ for rifle use, 21+ for handgun use, family tree can’t resemble a 2×4.

No.

You can decide how much ammo another person “needs” right after we let Hillary decide what kind of guns the American public “needs”.

Its the free market. Embrace it or boycott it, but don’t you dare try to control it.

Who said anything about need? Or me deciding?

The whole post was a swipe at the gougers, the idiots who buy at insanely inflated prices and those who believe Walmart ammo is deliberately inferior to the exact same offering at other stores.

Walmart as part of the mythical free market already decided on the 3 box limit. (Clearly doesn’t work)

Feds decided on the 18+ and 21+ ages despite almost any traditional handgun caliber you can get at Walmart being available in both hand and long gun. (I’m sure all the 19 year olds answer handgun)

The only new “rule” there would be is the completely unenforceable no inbreds camping out one. Surely you didn’t take that seriously?

Who’d? Come on.

Funny.

Who’d – As in – It was at the end of the concert so they “Who’d” all their instruments.

Who would pay 11 dollars for a 50 round box? I pay less then that for 223. Thats just asshat crazy. I pay 5 to 6 cents a round. 22 is selling for 9 cents a round every day on line. That is about 4.5 bucks a box not 11

Less than $11 for a 50-round box of .223 would put it in the ballpark of 20c/round. Are you referring to steel-cased Wolf/Tula/…? Because even for that, I couldn’t ever find it cheaper than 22-23c/round online.

Then pick me up a box or two the next time you go out because $10/50 is the going rate where I’m at.

It depends on what sort of ammo you’re buying for $10+ for 50 rounds. Match-grade (real match grade, not the “made into match grade by putting it in a snazzy box” type ammo, but real match grade ammo with Eley primers) ammo costs between $7 and $15 for a box of 50.

I keep a box of thunderbolt with a $1.25 price tag around for nostalgia.

Ha, I do sort of the same thing, only mine is a really old box of Winchester with a sticker from a local hardware store. It says $0.49. I think it’s one my dad bought, actually.

In the businesses I’ve seen real cost vs prices for, cost is expressed as a percentage of price, as is profit margin.

According to Mr. GradeSchoolMath, the profit margin on 22LR was 89%. To support that with current cost data, a brick of 22LR should cost about $88.50.

So who’s making out on 22LR?

We are.

This article’s sort of “analysis” is what makes people Feel The Bern.

I’m lost. The 1998 margins were both in the 100% range, with a box obviously making more. People were paying double the cost of production for their ammunition.

The current margin on a box of magic bullets (because who is paying $11+ for .22?) is 1000% and the margin on a brick is 300%.

I’ll admit that I normally pay 2.50 or so if I buy a box and the equivalent nickel-per if I buy a brick or other bulk box, so the margin is only 150%.

So, how am I making out in comparison to the past? With the cost of labor and shopping, I probably am in my personal purchases, but I don’t see that happening with the posted numbers.

Exactly, there is a lot of math missing from this article.

Example: Cost of material based on Google and not what is actually paid by the buyer who gets a much better rate due to the mass use.

Skipping the costs involved in smelting, casting, refining, powder, employees, overhead, shipping, cleaning, maintenance, advertising, outside sales, discounts to large distributors, 3rd party cuts, etc.. leaves a lot of money on the table, makes it look like mega profits.

Guns and ammo already dove into this mess and the actual truth is that ammo companies basically break even on 22LR ammo as an entry level item.

Don’t give up on the burger flipping job.

Inflation, labor and material costs, taxes, fees, regulation, supply and demand.

Don’t believe the bogus government numbers. I think they estimate inflation to be around 2% a year. My guess is that it’s more likely between 5-10% if not more. Was there any new law or regulation that would add substantially to the cost? Obamacare, for example. Even though it’s a fairly recent addition, anything like that or minimum wage laws would drive the price up. Any new fees or import taxes? You have to also account for the political climate. Over the past few years or more, the government has been sending mixed signals as to any new laws pertaining to guns and ammo. This creates uncertainty which makes people buy now and hold vs buying later or over time. Which means that demand is up. Which means the price will go up and stay there until supply is replenished and demand goes down. Of course, given the high inflation and new regulation, the price will not be as low as it was before. So don’t expect a crash or anything like that. Maybe a small pullback, if anything. But if an anti-gun candidate is elected president, it will get even worse.

Yeah, but for this exercise even “true” inflation isn’t really relevant. What we need specifically is the inflation (or not) in the costs of the actual inputs in making ammo. The raw materials (lead, brass, sulfur, etc.) are priced on the international commodities markets – they can fluctuate wildly and don’t really track inflation except maybe over 100 year periods. The labor component (i.e. wages) will better track inflation, but probably lag it (unfortunately for US workers). Distribution is essentially labor + fuel prices, the latter of which is also wildly variable.

If the labor cost includes health insurance, then it has certainly risen faster than inflation in recent years.

Thanks, Obama!

Any data to back that up? We humans are wired to notice when prices go up, but not down. Also, some things are more expensive, and other things less. For example, gas has gotten much cheaper, but there are other things that have gone up just as much if not more. MIT’s billion price index matches CPI numbers, etc.

For a deep walk through (by a Texan Republican) http://www.mauldineconomics.com/frontlinethoughts/your-own-personal-inflation-rate

Three words: “supply and demand.”

It’s what the market has decided the price should be at this point in time, and the market is efficient. If the costs are really as low as you figure, then nothing is stopping a competitor from entering the market at a lower price.

I wonder how accurate his numbers are. Seem like they’re guesses and/or estimates rather than accurate pricing. Shipping for example, is a huge cost and should have been taken into account. Oil is down now, but it was around $100/barrel for a while. Without all the numbers he can’t get an accurate cost basis. And you’ve made a great point: if the costs were indeed so low, another company could enter and start selling for much less than what everyone else is charging. But that’s not happening, which means right now there’s no way to get the price to go down. Not by much anyway.

Cost is up 100%

Price is up 400%

Basically that tells me all I need to know, and what I already knew. It’s much more about supply & demand than the increase in materials.

A few years ago a 9mm box price was $9, now it’s $11. Meanwhile 22LR had skyrocketed. Materials haven’t gone up differently for different ammo!

“Cost is up 100%”

Oversimplification.

Cost for basic materials is up 100%. What other costs go into the equation that were not counted here?

COGS of a product is only one line item on the balance sheet. There are many other expenses, some of which have to be passed to the consumer for a business to stay solvent. Shipping, for example, has already been mentioned; and that means shipping of the raw materials to the manufacturer…a cost incurred way at the bottom of the ‘supply chain.’

So has “inflation.” This analysis assumes the dollar has the same buying power that it did in 1998 – nearly 20 years ago. That’s a pipe dream if ever there was one.

Short version: a much more detailed analysis would need to be done before today’s “margins” are condemned as some kind of “bad thing.”

All of the same costs, inflation, etc, however, apply to 9mm ammo; if 9mm resisted inflation to the point that it actually costs less in inflation corrected $ than it did in 1998, but .22LR actually costs significantly more in inflation corrected $, then some other factor is almost certainly the cause. The theory he was putting forth is that it is supply and demand that is driving the relative price increase of .22LR as compared to 9mm (and pretty much everything else). Certainly that is most probably an oversimplification of the situation, however it has some merit. The only obvious flaw would be if .22LR requires a significantly different mix of costs (like a higher percentage is transport or labor, and lower raw goods, for example). To me it seems unlikely that that mix is as significantly difference as the sheer difference in rate of change of the retail price.

“All of the same costs, inflation, etc, however, apply to 9mm ammo”

Not necessarily. There is a tremendous complexity of market, political and cultural forces at work.

We have never seen the same profit margins for all ammo, not have we ever seen the same slopes of rate of change of those margins over time.

Even inflation is a flukey thing. It’s not really a single metric…there’s a kind of “micro-inflation” at work that affects different products differently. Another way of seeing the same effect is that not everything depreciates at the same rate (cars vs boats, for example…cars loose value MUCH faster and end at a much lower percentage of initial purchase price in general).

We are talking about the vagaries and peculiarities of “value.” Value is not a fixed thing, nor is it universal, nor is any snapshot in time perceived the same by all people. My son goes to trade cards with his friends, and sometimes the trades don’t make sense to me (not understanding the game THEY are playing)…but to them, they BOTH walk away believing they made out on the deal.

The ‘best’ answer is the “whatever the market will bear.” If people don’t want to pay an asking price for a product, they won’t. Just like those boys won’t trade Card X for Card Y if they prefer Card X to Card Y. It really doesn’t matter what anyone else says the relative value of the cards is.

The point is that there is no point in comparing .22 LR to 9 mm because the value perceptions are very different, just like there is no real point in comparing 2016 .22 LR to 1998 .22 LR. We can try to analyze it from a basis of “brass cost” and “lead cost” but such an analysis will fail every single time.

No matter how many variables you try to throw into the model, the model will fail to account for perceptions of real, underlying value and how those perceptions change with time. Such changes cannot be predicted.

Funny–the local Walmart has 50 round boxes of Federal 40 gr .22 for $3.27.

Two box limit? The wall mart here has two box limit.

Well, it’s three boxes here.

$30.00 bought me 500 Remington .22 Thunderbolts last weekend

http://picturearchive.gunauction.com/1314040125/12528268/thunderbolt-500.jpg_thumbnail0.jpg

Wally World? Pfft. THOSE guys must be camping out. I’ve yet to see ANY .22lr at WM since the ammo scare hit – EVER! Maybe THOSE GUYS will slow up but probably not as long as people will pay it.

My local Wallyworld here in Fla. has the ‘campers’, so to speak. All the local pawn shops know when the trucks come in, and have their guys there to get it before it hits the shelves.

The local Walmart here is cleaned out first thing in the morning on delivery day. I haven’t seen any on the shelves in a couple of years. So I stopped looking, and stopped shooting .22.

Just got the last three 100s at the other local Wally, first time I’ve seen it at that one in well over a year.

The gubment. Their tired of all the dead stop signs.

Why? Because new shooters, because suppressors, because “its for the kids!”, because Chuck Norris said so(I would never assume to know what Chuck did or didn’t say… Ever!), because “pew! pew!”, and because I’m sure a more socialized workforce doesn’t help the production costs.

http://intellectualfroglegs.com/wp-content/uploads/2014/03/1779268_10203315971240829_305516157_n.jpg

The .22LR’s problems:

1) Supply and demand.

2) Inflation (less value or purchasing power of currency over time.)

Both come from sh*tty government policies – don’t blame the ammo manufacturers.

The reason is margin.

$1.10 vs $10 in the old days would equate to $110 for $11.65 nowadays.

I think all ammo manufacturers had loss-leader 22s to encourage and assist new shooters. Inexpensive practice and recreation equal buying more guns and shooting more.

I know several new shooters that don’t own a 22 and never have. They started with a 9mm and shoot as much ammo as we used to shoot with a 22 at the range.

Not saying that’s a bad thing – just different. The ammo guys have figured out that ammo doesn’t have to be 4 cents a round to sell.

http://www.bulkammo.com/bulk-22-lr-ammo-22lr40lrnremtb-500

$88.00 FOR 500 ROUNDS RIGHT NOW!=SUX

2006/2007/2008:

I WAS BUYING 555 ROUNDS OF Winchester from Wal-Mart FOR $17/$18.00! No problem ever with shortages back then…. I haven’t seen those Winchester 555 round boxes or the 333 round boxes of Remington (costs 9 to 10 Bucks) in 6 to 7 to years!??? Somebody IS Making A KILLING! And it isn’t me…

That’s a bad example to be fair. Between gougers and those who are so far down the supply list that they just got stock in they paid for 9 months ago (at even worse prices) it’s easy to mess up the average cost. The bigger stores (when in stock) around me are all under 9c a round for CCI and 7c for bulk boxes. Now that’s not great but it’s not $88 for what ends up being 300-350 working rounds.

https://www.slickguns.com/category/ammo?caliber=3

Deals almost everyday spread about. Just avoid the suspiciously lower priced than everyone else, always listed company, they always list cheap and rape on the shipping.

People will pay current prices, it’s that simple.

If it starts to sit on the shelf, demand on the manufacturer will reduce, which means less hours running the machines with a fall in all those associated costs. The retailer will take a “hit” (after years now of “overcharging”) to get things moving, prices will find a new normal and the world will move on until the next scare.

Unless all the people who traditionally shoot .22lr, the ones who started to during the centerfire scarcity and new shooters move away from .22lr I doubt we will ever seen 2-3c a round again.

While it might be easy to “ignore” those other costs, one really has to take them into account…Labor, equipment & depreciation, utilities, other overhead (have to pay for the accountants..), taxes, etc. One cannot assume that these costs are stagnant over 20 years.

You’ve based your math on bad data. The price of lead for example could be much different if the factory requests a specific alloy (very likely). It also ignores that the brass comes in pre-processed shapes (sheet/bar/etc), which is much more expensive than scrap.

Casings are generally pressed from a small puck of brass in a hydraulic press using progressive dies to form it from the puck. This puck can be punched from a thick sheet or sliced from a rod of the necessary diameter. I believe to make the continuous process easier, they almost always use a sheet. ANY metal sheet is expensive, especially the wide and very long ones a continuous process machine would need, and especially when it’s made from an expensive metal.

This same crap was happening in 1967-68 when you actually had too sign for all the Ammo you bought, price of .22 went form .30 to .43, of course the Gov boys passed a minimum wage law of .75 an hr then 1.25 an hr!

Fast forward 40 odd years you got 15.00 hr, in some states we pay illegal Aliens more than that, along with the Muslims demanding Equity in a country they haven’t formed , to pay these scum suckers the taxes on industry increase along with inflation, so the only one making anything are the Illegals and the poor misguided terrorists seeking refugee status so they can get thousands of tax free dollars and pervert our countries value

“This scam is an ugly word”…hey I have NO plans for any 22’s. Glad I shot it when I was a kid…

I’m not sure where you are getting a 50 box of .22lr costing $11.65. I can get cheap Remington Thunderbolt boxes for $4-ish. A 500 round box for $27-ish. It’s been awhile since I bought any. I have a like 4k rounds of the stuff and never do get out to shoot it.

Do prices vary that much from state to state or something? My wife buys her .22 at either walmart or a few gun/sporting goods stores, and she’s never paid more than $5 for 50 rounds…. We’re in the greater Pittsburgh area in case anyone needs to make a trip out here to get there .22s.

There’s no doubt that prices have risen with general inflation, increase cost of labor, increased cost of energy to run the facility that makes the ammo, cost of shipping, etc. That’s all well and fine, but the problem is why is it so difficult to find the ammo? I can find CCI Standard Velocity, CCI Mini Mag, Remington Subsonic and Cyclone easily enough if I go to the stores that sell it, but every store in my area and seemingly online is impossible to get CCI Stinger, Velocitor, Aguila Supermaximum, Interceptor, and Winchester Hyper Speed. All the hyper velocity stuff is dead and gone.

Everybody has a different experience with the .22 LR shortage, some can’t find jack, others know where to go if they really want to buy it and for an above normal price.

My point is it seems like the current prices aren’t able to quell demand, so what prices will keep the stuff on the shelves? It seems the higher the prices go, the more people sense a panic and buy it up. Where’s the equilibrium where people say no mas to buying .22? $1 per shot? $2 per shot?

I would wager that most .22 is sold online today, not via retail stores. Thus, the shelves get whatever’s left.

If you look online, you’ll see that there are plenty of offers, and the prices have already gone below 8c/round fpr the cheapest stuff – and they keep falling, slowly but steadily.

The real problem is that most retailers are afraid to raise prices to where they need to be to stabilize the supply/demand curves, because they’ll have tons of idiots who have no understanding of basic economics screaming “price gouging” if they do. So they sell at less-than-market prices, and the opportunists buy it up and re-sell it at a huge markup.

How long ago was it that Thunderbolt 22 and Wildcat 22 was 50cents for a 50rnd box? It just cant have been that long ago then the next time I looked it was $2.50 a box. WTF?

The cost of manufacturing is completely irrelevant.

Right now, every factory in the country that can produce .22 LR, is producing .22 LR – non-stop. Yet, they cannot satisfy the demand.

In such circumstances, the buyers aren’t paying the sellers for the cost of the materials or the labor. They’re paying for the privilege of being the first to get the fresh hot box off the assembly line. And that price is determined entirely by the market.

That is as it should be. There are no monopolistic forces here – there are many companies in this business, all competitors. It just so happens that the main competition right now is between buyers rather than sellers. The sellers can sell every single box they make as soon as they put it onto the shelf, so why would they lower the price?

If you have objections to it, you’re welcome to open (or pool resources with someone else to open) your own business manufacturing and selling .22 LR rounds, slice the margin by half, and still make an impressive profit. In fact, given how long the demand has been sustained, it would be a very lucrative business investment, and if I had that kind of money around, I’d seriously consider it.

Right now, every factory in the country that can produce .22 LR, is producing .22 LR – non-stop. Yet, they cannot satisfy the demand.

And a company down the street from me is turning out Starfighters at full production too. So far they have turned out 0.

The point is that production companies can tell you anything they want and the world is forced to accept/live with it.

In 1980 when cars were lined up for blocks to get 10 gallons of artificially rationed gas there were over 8 oil tankers sitting low (full) outside the breakwaters of Florida. They were there for weeks waiting to unload and why- because the onshore facilities (oil companies) tanks were full and workers were being furloughed three days a week.

As far as the OP’s original post it plainly states that he is only looking at the specified costs of both time periods. I think he did a good job of showing the different costs associated for both periods. His selling prices seem to be an average of what .22lr is going for. Sure there are cheaper places when you can find it and higher prices are the norm. Also I see comments concerning buying so cheap on the net but the prices stated do not seem to reflect the cost + shipping.

There are probable flaws in his original post but overall I agree with the bottom line. .we are being gouged by everyone concerned with today’s pricing.

Even if all of it is true, so what?

There’s no monopoly. There are no patents restricting you from manufacturing .22 LR. Basically, there are no artificial barriers to entry.

If you truly believe that everyone in the business is gouging by artificially restricting supply, then that’s your opportunity right there to do a service to the community (by gouging less) and make boatloads of money at the same time.

But, precisely because of that, I very much doubt that it is actually a conspiracy. Because if it were, someone would have cashed in on it long ago, and drove the prices down.

A much more likely explanation is that there really is that much more demand, and manufacturers are reluctant to install new hardware to increase their production capacity, because they don’t know how much that demand will last (and, perhaps, specifically expect it to wind down eventually). And thus they just run what they have at full capacity, but it is still not enough to satisfy the demand.

Black Friday sales are the only times nowadays where you can get 500rd bricks for $19.99 or 24.99 each.

Comments are closed.