Last year, Foghorn did his usual thorough job of covering the basics of buying a suppressor. In that article, Nick ran through the basics of selecting one and provided an overview of the steps you’ll have to go through to get one transferred to you. His post covered the process if you’re buying as an individual. Since then, we’ve had a few requests to cover the process using an NFA trust. And since I’ve just recently done just that, I’ll take this one.

Let’s assume that you already have an NFA Trust set up. Because if you did, why would you be reading this? You may want to start with my post, “Want a Suppressor? Consider Setting Up an NFA Gun Trust.” In it I cover the benefits a trust offers and discuss the process to make it happen. There are a couple of things to keep in mind here. First of all, a trust conveys three main advantages:

- No CLEO sign off required to submit your paperwork

- No fingerprints or photo required to submit your paperwork

- NFA item is registered to the trust rather than to any one person

That last advantage is worth noting. With a trust, you have the freedom to amend the list of trustees at any time. That means multiple people can be authorized to hold the NFA item in their possession. If you register as an individual, you have to be present whenever the NFA item is out of your safe.

One final note before we get into the meat of the matter — don’t try and do the trust thing on the cheap. With a trust, you’re using a legal construct to purchase highly regulated items. Screw it up and you could be looking at a felony conviction and permanent loss of all of your firearm rights.

So get a competent attorney to do it or use one of the well known legal services such as the Apple Law Firm’s GunTrustLawyer. These guys have been doing it for a long time and their boilerplate document pretty much has all the bases covered. Plus, they partner with lawyers in each state to ensure that your trust complies with any state-specific laws, too.

Okay, so you have your trust set up and are ready to go. Here’s what you need to fill out:

Box 1: Check the type of transfer (usually $200)

Box 2A: Your trust’s name and address (this should be the same as what appears in your trust documents). County goes in box 2B

Box 3A, 3B: Dealer’s information goes here

Box 4A: Name and address of Manufacturer of the suppressor

Box 4B: Silencer (don’t use any other term)

Box 4C: Primary caliber of the suppressor

Box 4D: Model of the suppressor

Box 4E: Ignore

Box 4F: Overall length of suppressor

Box 4G: Serial number of the suppressor

Ignore Boxes 5 & 6 unless you are an FFL. You DO NOT need to put your SSN anywhere as you’re not buying the suppressor – your trust is. Nor do you need to obtain a tax ID for your trust and use that either.

Box 7 – 10: FFL information & signature

Boxes 13 & 14 – Answer all questions truthfully, but chances are a “Yes” anywhere will mean trouble.

Box 15 – Name of trust goes here. “All lawful purposes” is the reason

Signature – Sign as trustee, so I would sign XYZ Trust by Jim Barrett, Trustee. Date it.

You’re finished with the form. Now go back and double check everything, otherwise you will be in for a longer wait if there are errors to be fixed.

You’ll need to submit two original copies of the form. This is a two-sided form and your submission must be two sided as well. You can’t submit two single sided pages stapled together.

You will also need to submit an ATF certification of compliance (form 5330.20). Fill this out and sign it the same way you did the Form 4 – as trustee for the trust.

Along with these two ATF documents, you’ll need to send a copy of your full trust document along with any amendments. In my trust package, the lawyers also included a one page ‘assignments’ page on which I explicitly assign the suppressor to my trust. The guidance given with the trust document says this is necessary. I didn’t do with with my earlier suppressor purchases and the transfer still went through. That said, it’s no big deal to do it and your NFA inspector might be more rigid than mine was.

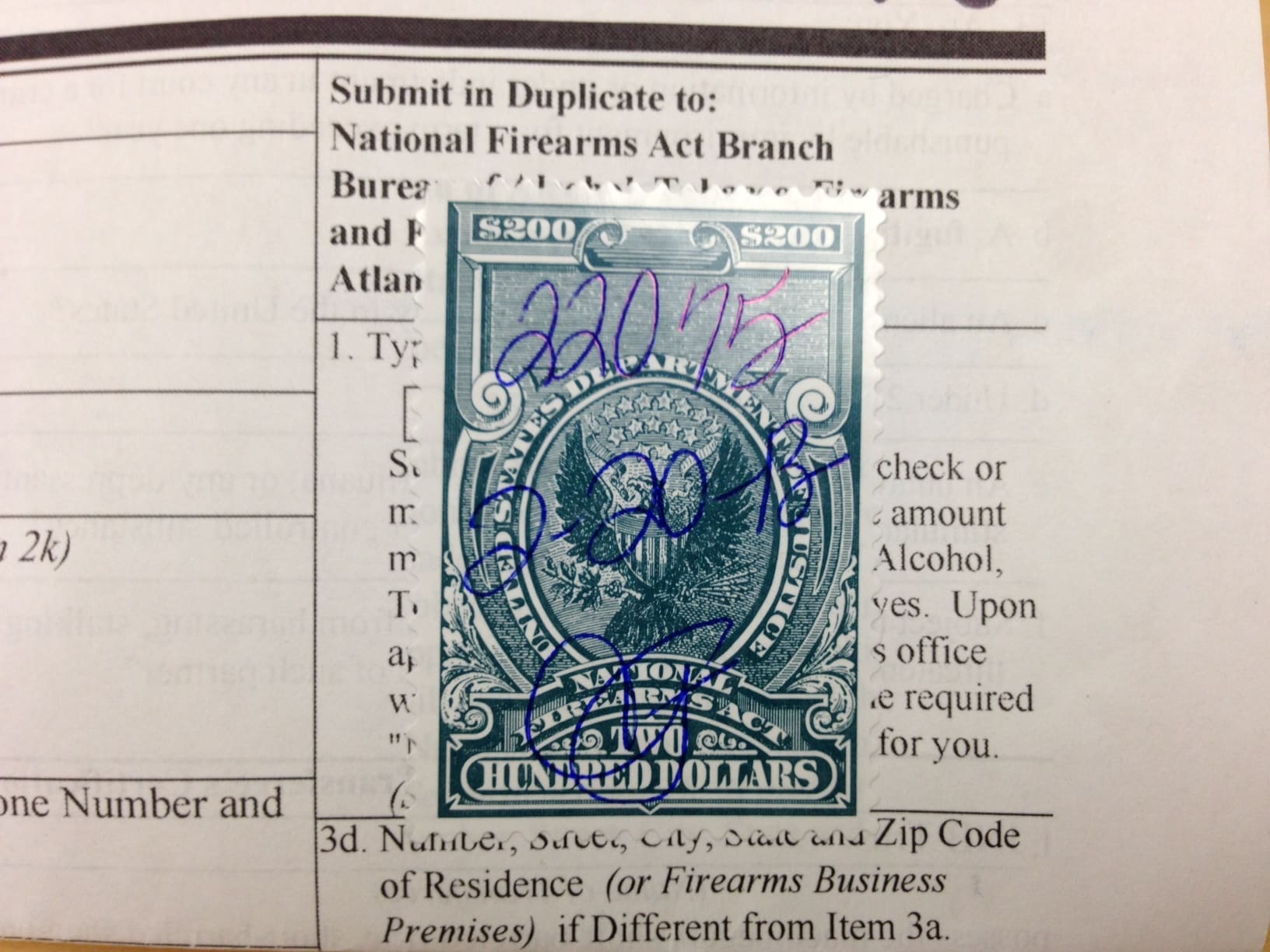

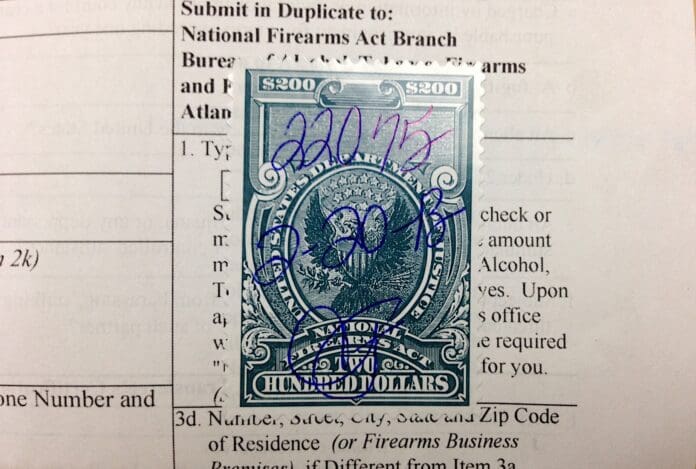

Finally, you need to send in payment. To distance myself from the trust, I used a bank check rather than a personal one. This way, there’s no record with the ATF that could be used to link the suppressor to me rather than my trust due to the method of payment for the tax stamp.

That’s pretty much all there is to it. Other than the months of waiting. Good luck and let us know how you make out.

“This way, there’s no record with the ATF that could be used to link the suppressor to me rather than my trust”

Wouldn’t your signature on the form do that?

If you are a trustee I would think your signature is the required one.

I think what he means is that the use of a personal check could have the appearance of being personal funds, where the bank check makes it appear more as a business transaction. If you sign as a trustee, then you could view it as similar to signing for a delivery at work. Just because your name is on a FedEx slip doesn’t mean a milling machine your boss ordered with company funds belongs to you personally.

Some people also go so far as not only paying for the NFA stamp with a bank check, but they do the same for the actual NFA item. Others don’t think it matters that much. I don’t know either way.

I can see the logic behind those saying that if you pay for it, but the trust owns it, that might not be entirely legal (kind of like you’re straw-purchasing it for your trust). I don’t think that’s how it works, but I can see why people might think so.

Chris Dorner seemed to claim he bought his NFA goodies with a trust for only a $15 notary. It appears that doesn’t get you away from the $200 stamp, right? I already consider him a lieing sack of , but can anyone clear that up?

My guess is thatvhe means he downloaded some trust boilerplate and had the notary witness his signature. The $15 was for the notary’s services. That is totally unrelated to the $200 you need to pay for the tax stamp.

As I said in my post, given how regulated this is, it’s worth paying an attorney to ensure it is done right.

It sounds, then that this could be achieved in California. Right?

I’m not a lawyer, so I can’t say for sure, but I’m pretty sure that any non LEO/MIL prohibition on silencer ownership would apply to companies, trusts, etc.

I have a trust and bought a suppressor with the help of my FFL. Since a SBR is more hands on can you give instructions on that too please?

Well, I could tell you how I filled out my paperwork, but it omly hit the initial proessing step at the beginning of January, so there are a few months to go before I know if I did it right. Check out the guntrustlawyer blog I referenced. Theyvhave example paperwork for a Form 1. The only place that Ivdeviated from their guidance is that I did not use my SSN. Didn’t need it for my suppressors,vso I can’t see needing it for the SBR.

Also, don’t have all the parts to build the SBR in one place before you get the stamp. ATF views that as constructive posession and that can be trouble.

Hi Jim,

We are starting up a brand new association called Concealed Carry Association of North Carolina. We are trying to provide current and accurate information for concealed carry owners in NC. We are looking to partner with writers and experts like you to build a database of content for our members. As we are just getting started, we do not have any reservations about using previously published articles to create this database. We are interested in possibly purchasing some of these articles as well as new, unpublished material in the future as our membership grows. These articles can range from product reviews, tactics and techniques to avoidance of dangerous situations. We are set to launch on April 1st and are hoping to have your support. If you could email me at [email protected], I would be happy to provide you with more information on what we envision for CCA of NC.

Thank you for your time,

Lauren Lowry

Concealed Carry Association of North Carolina

http://www.ccaofnc.org

*Ahem*

http://www.reginfo.gov/public/do/eAgendaViewRule?pubId=201210&RIN=1140-AA43

Looks like while Biden was running his shell game other lackeys were doing their homework. I wonder what other executive adjustments will start poking up?

Seen this. All the more reason to get moving now and get in line before this takes effect. It would eliminate some of the value of the trust, but what’s not clear iswhat happens when you add trustees down the road. They may not have to undergo a background check.

Regulatory Flexibility Analysis Required: No

Government Levels Affected: None

*****Small Entities Affected: No*****

Federalism: No

Included in the Regulatory Plan: No

RIN Data Printed in the FR: No

Are they claiming that if your trust is a ‘small entity’, it won’t ‘affect’ you, and you won’t have to submit fingerprints???

What’s the regulatory definition of ‘small entity’, is it one with less than 50 owners, one with less than a million in assets?

It’s very important to first get a copy of the silencer’s Form 3 (dealer transfer form). Information between the Form 3 (Box 3) and Form 4 (Box 4) should match exactly. Otherwise the application could get kicked back or enter problem status.

On the 5330.20 Compliance form, you do not have to sign as trustee, just your full name with middle initial. The form clearly states “Signature of Individual Who is Identified in Question 2.”

And they don’t care who pays the $200 tax and by which method. The $200 is merely stripped out and processed in Atlanta, before being shipped off again to WV, where the real application process begins.

Setting up a Trust is the way to go. I just set mine up a the beginning of the month and submitted a form 4 and form 1 on 2/15. Now the 6 month wait begins.

Forget the lawyer. Fill out the form, notarized and send in. BATFE isn’t going to arrest you for a misspelled word. Worked splendidly for me.

Heyther’s lots of stuff you can do without getting professionals involved. You can brew your own painkillers, make your own fireworks, and build your own airplane. Sometimes it works and sometimes it goes up in a firey explosion. I’m glad it appears to be working for you and hope it continues. Me, I’ll get a pro to do it.

For the record, there are a lot of good lawyers out there in your local area that can help you draft an NFA trust. I am one. If you are in AL and are considering having a custom firearms trust drafted, please check out my website http://www.ALguntrust.com. I would be happy to help you.

While I don’t disagree with “Don’t try to be cheap,” I do want to point out that of the half-dozen places I know of off the top of my head to have an NFA trust done in Florida (and I’m talking about those done by attorneys who have done lots of them), the Apple Law Firm that Jim linked in the post above is by far the most expensive. They quoted me $425, most other places are $2-250. Do your research.

No argument that there are cheaper places. You just want to make sure that you aren’t getting some attorney’s boilerplate revocable trust doc onto which he’s tacked some NFA language. On te other hand, ifvthe attorney hasdone a number ofthem, then you should be good to go. One thing you don’t want is to find putafter waiting six months that the ATF does not accept your trust as drafted. Using an attorney with an established track record at ATF makes your application more likely to sail through without issue.

“They quoted me $425, most other places are $2-250. Do your research.“

$200 of that goes to Jim ev time someone uses that firm via the link…..huh Jim? Lol All kidding aside I’ll be using professional direction. Thx for the read and info. Big help.

“… don’t try and do the trust thing on the cheap. With a trust, you’re using a legal construct to purchase highly regulated items. Screw it up and you could be looking at a felony conviction and permanent loss of all of your firearm rights.”

You got to be kidding me! Felony conviction? Permanent loss of all your firearm rights? Let’s scare people now! For cheap what do you think about nothing? That is what I paid for my trust. The dealer had it. It is just a boilerplate document is all. Go ahead and pay an attorney $2,000 for one if you like. He will just insert your name on a Word document and push print.

Honestly, the is nothing to buying a silencer. I have purchased three, many of my friends have bought them and we all used trusts. And guess what? None of us are in prison!

I get a little tired of people saying how difficult it is to buy a suppressor. Sure they should be an over the counter item like they are in some countries. However, I wouldn’t trade our gun laws for theirs. They may be able to buy a silencer easier than here but getting the gun to put it on is far more difficult.

If you have a difficult time with the paperwork buying a silencer what you need is a new dealer not an attorney.

Yes, the Bat Feces does indeed submit felony cases for filling out paperwork in a reasonable manner that they claim to be unlawful. (example, writing “Y” in a box on a 4473 instead of “YES”.

However, being 100% in compliance with the law in no way prevents you from getting a ten year vacation in Club Fed. Innocence is only a defense if you receive a fair trial. Ask the Reese family how fair our feral justice system is.

I do not see what putting a Y instead of Yes on a 4473 has to do with getting an attorney for a trust. The paperwork for trusts is available and has been used literally thousands of times without anyone going to prison or a case being filed. No attorney is necessary if you go to a dealer than has done this numerous times. An attorney only adds unnecessary expense and will sell you the exact same thing, possibly not as good unless he has done it as often as a dealer which is doubtful.

However, I would like to see these examples of the ATF sending someone to prison for 10 years for putting a Y instead of Yes in a box on a 4473. I think you are exaggerating not a little.

I don’t know of anyone going to prison for filling out yellow form wrong, but I know of two Gun Shops in the San Francisco Bay area that were first vilified and then had their FFL’s revoked for “Y” instead of “YES” on the form. Even thought he form did not have a box that was really big enough to write the word Yes in it. Both of the shops had been in business for over eighty years and were suppliers to the local police departments in their respective cities.

I’ve had shops get testy and make me scrap the form I’m filling out and start over if I write Blvd instead of Boulevard (try that in the tiny little Number and Street Address box) or FL instead of Florida (in a box that’s two letters wide). I just shake my head when they insist on not abbreviating Florida. It spills all over into the ZIP Code box, and looks like hell, and the box was clearly designed for two-letter abbreviations.

First of all, no one is talking about spending $2,000. Even the expensive trusts are less than half that amount. Secondly, given some of the crap the NFA has pulled over the years, do you really think that they couldn’t find a problem with an “over the counter” insta-trust like what your dealer probably had? You are right that the lawyer is simply going to insert your name and a few other things into semi-boilerplate, but where do you think that boilerplate came from? It took a lawyer’s time to draft it initially. Also, when a lawyer drafts a document for you, he/she is exposing himself/herself to liability if the work was done wrong. This is part of the cost.

If I have a problem with my trust, I have someone to go back to who will work with me to argue the validity of the trust to the ATF.

Since I’ve never seen your trust, I can’t say whether its a good one or not. Obviously, the ATF have accepted it or you wouldn’t have your suppressor. That of course doesn’t mean that down the road you won’t have problems, particularly if the trust has not properly handled disposition of the trust assets in the event of the death of the trustees.

I certainly believe in saving money where possible, but please don’t minimize the possible risks inherent in a poorly constructed trust. While you may never face any prosecution, it sure would suck down the road if your kids had to forfeit your entire NFA stash because Daddy took some short cuts and didn’t set up the trust document the right way.

Jim,

Where do you think the dealer got the boilerplate trust paperwork? For that matter, where do you think the lawyer you pay $2,000, $1,000 or $500 or whatever got it? This is standard stuff. If you go to a dealer that has been selling silencers for years and using the same paperwork you are NOT going to have a problem. You’re just wasting you money and adding extra unneeded complication to buying silencer which is really a very simple process.

I am not sure why people seem to have this need to make a big deal about buying a silencer. It is far less trouble than buying a gun in most countries. The only hassle is the wait as of late since they have become so popular for some reason and the ATF is backlogged with applications.

Thanks for the write-up. I have a question about this being that I live in NJ. Using this process I understand how I could get a silencer but I believe threaded barrels are illegal in NJ for us “servants”. Would I use the same process to acquire a rifle with a threaded barrel to accept the silencer or am I s.o.l. because threaded barrels are banned in the first place?

You’re SOL, sorry. Remember that getting a trust is not “getting around” the law, it’s just a different way of complying with the law. The trust method for Title II ownership only gets you out of two things: the background check (which isn’t really a big deal, and is not the reason that most people want a trust) and the CLEO sign-off (which is supposed to be a formality, but some CLEOs flatly refuse to sign. This is/was the original, primary reason most people wanted a trust.).

This is not a method of avoiding or negating the law, as it doesn’t trump local laws. Thus, people who live in states that don’t allow silencers still can’t have one, even using the trust method. In your case, a trust would have no effect on your local law that prohibits threaded barrels.

There might be a novel way to get around the issue if you don’t mind spending the money. I’m not familiar with NJ law, but in some states, if the flash suppressor is pinned and welded to the barrel, then the fact that the barrel is threaded is immaterial.

Some of the suppressor manufacturers (AAC for one) make quick attach suppressors. The way these work is that you affix a combination flash suppressor/quick attach mount to the end of your barrel, then you simply snap the suppressor on and off. You *might* be able to have someone pin and weld one of these mounts to the end of your barrel. At that point, you would no longer have a threaded barrel and could legally possess that gun. You could then get a quick attach suppressor and use it whenever you wanted.

Unfortunately, I think that suppressors might be illegal in your state:

2C:39-3. Prohibited Weapons and Devices.

c.Silencers. Any person who knowingly has in his possession any firearm silencer is guilty of a crime of the fourth degree

If you live in New Jersey and own a gun, you ought to know the laws. Threaded barrels are NOT illegal. Spreading misinformation doesn’t help anyone.

You’re permitted two “evil” features on semi-auto firearms (let’s just stick to rifles rifles at this point). Threaded barrels are on the list, as well as pistol grips, and detachable magazines.

M1A: threaded barrel and detachable magazine. AR15: pistol grip and detachable magazine. Want a muzzle device for your AR? Must be pinned.

Don’t take my word for it, though. Read up.

This seems like a lot of work and leaves a paper trail. It’s a shame that suppressors are so difficult to make.

They are not that difficult to make. The issue is that whether you buy or make, you will still need to file a Form 4 or Form 1 and go through the paperwork and approval process. The NFA regulates all devices that function like suppressors.

My comment was sarcasm. I’m just wondering how long we will continue to bend over to the Unconstitutional laws and regulations that are thrown at us?

Well, any time you are ready to lead the revolution, I’m sure that lots of folks will be behind you (way, way, behind you). Problem is that while I completely agree that silencers should not be subject to these foolish regulations, they have been since 1934 and it would take a positive act of Congress to change the laws.

Congress does not seem to be in the habit lately of doing anything positive and even if they were, something tells me that any attempt to loosen gun laws at the Federal level right now would have about as much success as attempts to tighten it. Plus, no way that the O-meister would sign off on it, so it’s a dead issue until 2016 at least.

Jim,

I won’t be leading any overt revolution, I’m just as cowardly as the rest of gun owners.

One hundred million firearms owners, absent cowardice, would have an lot of influence on returning our political system and government to its Constitutional bounds. Cowardice may be too strong of a word, maybe dependent on a government check would be better.

I do have a question. If you have a revocable Trust already set in place can you add the NFA Trust section to it? Or is it a totally separate Trust?

Can you put it in the same trust? I’m not an attorney; I have no idea. However, because the rules for NFA items are so different from virtually any other tangible personal property you’d put in a trust, you probably want a separate trust just so the NFA items can/will be handled differently.

I have a NFA trust and I have a class 7 FFL license. If I purchase a suppressor can the manufacture ship it to me and I place it in my A&D book as received and transferred to my personal collection>

Thanks.

Dan Thomson

Of course after the necessary paperwork. Just wondering if having the class 7 license shortens the process?

I’m currently a student, but would like to buy a suppressor for my favorite gun. I live in Kentucky, but will likely end up in Texas sometime in the next 5 years. Is there a problem with setting up a trust now and buying a suppressor? Should I wait until my location is more permanent?

There is no issue. You just fill out a notification form for the change of address when you move. This is only necessary on interstate moves, not intrastate.

Hey there, I just got my stamp back for a SBR I placed on a trust. If I want to purchase a suppressor am I going to have send in another $200 or just amend the trust and send in a new form?

If you get a suppressor it’s another $200 dollar stamp. Each NFA item requires a $200 dollar tax stamp even with a trust. I wish it was one stamp to rule them all.

As Wes said, each new Title II item you purchase is a separate tax stamp, and the Declarations page of your trust will need to be amended to reflect the change in the assets assigned to the trust.

I am buying a silencer going the trust route. If one of the trustees has a C&R License must that be listed or the form 4? Or does box 5 on the form 4 only apply if the trust has an FFL?

because atf takes the trust gives u the stamp dose not make trust leagle.

this where u must be carefull is the trust leagle in your state, I no lawyer

but all I seen is on trust u make sure u have your state laws spelt out

in ohio there 6 or 7 things turst must pass to be leagle

and each these should be on trust,

also spelt out atf laws on guns,

state laws on guns

I my self added these things and define equal rights and grandfather cause

as all these things are look at in a trust,

thing is on gun trust u must make sure them people know how to

change the trust and how to transfer class 3 guns

if u don’t tell them wont get done

now weather or not they require to pay 200 tax stamp

or is it easyer convert guns back to type 2 guns

wich if convert back to type 2 gun nothing has happen

I was denied my stamp because I screwed up. I used my full name first middle and last name as my trust name on the application but it’s abbreviated in the trust paperwork cause I was reading that the ATF like to see it that way. Stupid me ! !

Also they said I have to file a 5320.1 application instead of the 5320.4 cause I’m building it I sent it in February of 2016 got the results on May 27th 2016 they signed it on the 20th of May. Is this typical BS ! !

I have an NFA trust and plan on purchasing a suppressor. When filling out form 4 for tax stamp, how do I get the suppressor’s serial # if I haven’t purchased it yet… Let say I purchase online from silencershop.com and pick it up from a local dealer. Do I need to purchase, wait for it to come in, go to shop and ask for serial # then fill out form 4? Silencershop says they take care of transfer fees and paperwork but I’m not clear on whether I need to purchase stamp or suppressor first. If the stamp comes first how do I know all the details if I can’t purchase without stamp…? Thanks for your time and info!!

You get the Suppressor first. When it comes in (The FFL should notify you), then you go in and get the information required to fill out your Form 4.

As of July 13, 2016 you need to have a 41F, which includes passport size photos and fingerprints of each person listed on the NFA Gun Trust (Trust owner and Co-Trustees) along with Form 4. Also the Trust owner and Co-Trustees names are on it. The ATF knows exactly who the people are

Comments are closed.