This is the second of a five-part series on cryptocurrencies as well as their uses benefits for the Second Amendment community. Read part one here.

By Rob McNealy

Non-fungible tokens — NFTs for short — are all the rage right now in the crypto universe. NFTs are a type of crypto token which any sort of digital media files can be attached to, allowing them to be easily and securely traded like stocks. A great analogy would be to think of them as digital baseball or Pokémon cards.

NFTs are unique digital identifiers that cannot be copied, altered, or subdivided, and are permanently tracked and recorded on a blockchain. NFT’s can be used to certify the authenticity and ownership of digital art, music, software, and movies.

NFTs can easily be bought, sold and traded on NFT marketplaces such as OpenSea, which is built on the Ethereum blockchain, and Ruzi, which is currently being built on the TUSC blockchain.

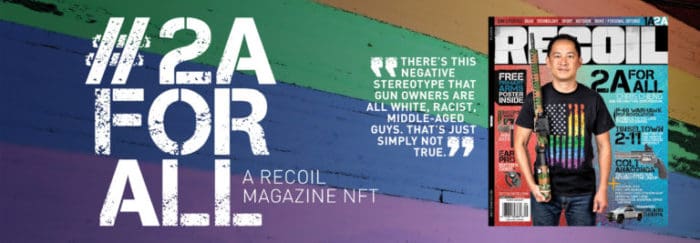

Some recent examples of 2A-related NFT projects include Barrett Firearms as well as a charity NFT collaboration between Chris Cheng and Recoil Magazine.

NFTs have the potential to revolutionize many industries. Two of the most fascinating NFT use cases are video games assets as NFTs and the fractionalization of real assets into NFTs.

In video games, players normally don’t actually own the assets they accumulate, win, and buy, the value of which is often huge. However, in-game assets could be created as NFTs, which could then be bought, sold, and traded on NFT marketplaces, outside of the games they are used in.

NFTs can also be used to represent fractional ownership interests in physical goods, like digital deeds of ownership. Those deeds could also be traded in NFT marketplaces like Ruzi.

The wealthy often invest in things like fine art and rare gun collections. Those types of investments have historically had great ROI over time, but were outside the ability of the average person to invest in. NFTs change that.

For example, a group of people could create a non-profit DAO (decentralized autonomous organization) for the specific purpose of buying and managing a rare gun collection. Then they could issue/sell 100,000 NFTs that each represents 1/100,000 ownership in that rare gun collection. Each NFT holder is now a partial owner in the underlying asset, and they could buy and sell those NFTs as easily as stocks.

Read part three in this series here.

This is the second of a five-part series on cryptocurrencies as well as their uses benefits for the Second Amendment community. Read part one here.

Rob McNealy is an entrepreneur, 2A supporter and co-founder of TUSC, a 2A-friendly crypto payments and NFT project, and Krappy Art, an NFT and digital art collective. Rob lives in the Salt Lake City area with his wife, four kids and their ferocious guard doodle. You can listen to his podcast or follow him on Minds and Twitter.

NFT’s…the emperor has NO clothes! SEE:The South Park covid special😏

Isn’t Chris Cheng the guy who threw “assault weapons” under the bus for us lowly peasants?

I work at a hedge fund. Our clients are endowments, so pension funds, family offices, etc. Before that I worked on the sell side. If there’s one thing I learned in my years in finance, it’s this:

DON’T INVEST IN THINGS YOU DONT UNDERSTAND

There is no “there” there. Unless you understand what Tether is, do not touch crypto currency. When someone is pushing NFT via sod0my into the gun community- run.

If anyone is giving you financial advice that doesn’t involve: living below your means, paying off debt, Vanguard index funds, and maxing out tax-advantaged/retirement accounts/your kids’ 529s- as the foundation…

you’re the mark.

Amen.

“The wealthy often invest in things like fine art and rare gun collections.”

No- they invest in conservative asset allocations (think your age as a percent in bonds), real estate, and maybe LP in private equity syndicates. Most of the wealthy I know hate guns, and those that don’t view them as toys- not investments.

Source CFA and CFP

Seems like sound advice if the dollar is worth anything in 20 years.

If people don’t understand it, that does not make it brilliant.

Avoid this crap like the plague.

I clicked on the Barrett/Recoil charity link:

“You just bid on the Non Fungible Token (NFT) auction of Top Shot winner Chris Cheng’s RECOIL #56 cover on October 19th, 2021. You won it. Your bid just went to fund three gun rights organizations: Firearms Policy Coalition, the Pink Pistols / Operation Blazing Sword, and the Asian Pacific American Gun Owners Association.”

I do not want to be associated with this. Is Barrett woke now too?

Interesting comments after mine! He he…

You bid just by clicking on the link?

Very disappointing

Shame on TTAG for allowing this. Readers should feel insulted that homosexuality and a NFT Scam are being pushed on them.

I don’t want to buy a picture of a gay guy. I just don’t.

We believe guns are for everyone. And we’re not pushing anything. The views expressed in the article are the author’s. Don’t like that? You’re obviously in the wrong place.

https://www.thetruthaboutguns.com/recoil-magazine-takes-blowback-for-chris-cheng-cover-art/

Guns are for everyone except marxists. No rights for the filthy swine that push their sexual agenda on kids. Not all gays are marxists, but their movement has acted almost exactly like any other marxist group looking to ram their agenda down your backside.

“ram their agenda down your backside“

Interesting choice of metaphor, you seem really excited by the prospect.

@Dan: I do not understand why you would double down on the statement that if we do not like the views presented by the authors then we are in the wrong place.

You then link the article from the summer when you stated “You certainly don’t have to agree with that stance, but if it upsets you, then neither TTAG — or RECOIL — is the place for you.”

What good does chasing readers away for disagreeing do for you or this site? I’ll tell you at least one negative impact it will continue to have: causing discerning readers to see echos of marxist cancel culture creep in here.

We’ve always taken a guns-for-everyone stance. That isn’t going to change.

That means posts and opinions that some of you won’t agree with. We’re not an echo chamber for anyone and we’re not going to change that or apologize for it. And “marxist cancel culture?” Please. There’s none of that here and you can’t point to a single example.

So as I’ve said, if that upsets you, this probably isn’t the place for you.

Are guns and this website for Christians that oppose homosexuality? Is it for white men? Is it for people who believe in not pushing NFT scams?

Because I, as a white Christian, do not feel welcome here.

You’re not welcome in the US of A either, maybe a move to Russia is in your future.

Crypto currency? No thanks. Tangible/liquid assets only for me. But, thanks anyway.

The NFT concept is good, but just like any kind of physical serial number, if the thing it is attached to, digital or physical, is worthless so is the NFT (or serial number). Shades of the dot com era when stupid people and companies seemed to think that ended in .com was worth putting money into…I had hoped people had gotten smarter.

Joe Kennedy, a stock investor in the 20’s, said he knew it was time to get out (before the crash) when his shoe shiner started giving him stock tips. I remember the dot com boom. Everyone was investing right before the crash. I remember the real estate boom of the early to mid 2000’s. Everyone and their brother was a contractor or a real estate investor. If everyone else is getting in on it, then you probably missed the boat. Want some investor advice? Copy Nancy Pelosi. She knows things you don’t.

I had always heard the story as JP Morgan. But whichever, the point is a good one and worth remembering. Not only about money but guns, cars … so many things.

Unfortunately the twitter tracking her stock purchases (completely legal reporting of open information) got suspended.

Every new paradigm shift has a hype bubble around it. Crypto will too. That doesn’t mean there that the tech is bad or isn’t going to revolutionize things.

E-commerce came out of the .com bubble.

The point of this article was to explain new things to people. No one here was pitching or telling people to buy anything.

Crypto and NFTs have some amazing potential.

Ah … as per the first line, isn’t this the second article in the series, not the first?

I noticed that also. If he can’t get something that obvious correct, then, well, no thanks.

people that can’t count to two promoting cryptocurrency

LoL 😂

So, it’s unsafe to own a gun that doesn’t have a serial number engraved on it, but it’s perfectly safe to park your life savings in some made up shit because you get an electronic serial number as proof of its “existance”?…. I fear for the future.

If you “park your life savings” in something new that you don’t understand, you are not a very shrewd investor. Also, every dollar, check and debit card transaction has a serial number on it too.

The problem is dollars are losing their value more every single day because of inflation, and gold doesn’t seem to moving much to offset that. In fact, gold has done poorly over the past decade.

I’m kinda wondering; what does a bit-coin have to do with a firearm?

nothing. Its basically being touted as a way to pay for stuff like firearms and related.

Supposedly, as its frequently touted, there is all this security and anonymity with bitcoin transactions that supposedly makes them ‘untraceable’ back to an individual – all with an idea to hide such people and their transactions. However, the U.S. Government manages to still track bitcoin back to individuals and seize their bitcoin.

Its not just bitcoin, its the same for all cryptocurrency including the ones being hawked in this “series’ of articles. The government can still find out who you are with all cryptocurrency, they can also interdict those transactions. Its not hiding anything.

cryptocurrency was intended as a decentralised digital currency, not subject to any government or central authority. This is also one of its weakness areas, anytime you decentralized digital or real world financial assets (e.g. money) that can have real world tangibility its like putting out a sign that says “Thieves and scammers invited”

The most recent seizure was in November this year (2021) – The U.S. Government seized $56 million worth of cryptocurrency from a BitConnect scam participant.

Although its downplayed a lot, the key strategy involved in cryptocurrency is to promote it to get people to buy into it thus in some way making the founders of the cryptocurrency more wealthy. At its basics its touted as a way for people to easily invest in cryptocurrency and to make a lot of money doing so.

This is an area fraught with scam and theft. It has made its rounds in various other ‘communities’ which have all basically rejected its application due to these many weaknesses and susceptibility to scam and peoples money just vanishing over night in ‘exchanges’ with no hope of ever recovering the millions stolen.

Its made the rounds, now its the ‘2A/gun” community turn.

.40, you explained a lot. But if I wanted anonymity why wouldn’t I just meet a seller, give him a fist full of $100 bills and be on my way? I’ve done it a thousand times.

Cash is the true anonymous medium of exchange, that is why the feds want to monitor any account you you have and every transaction, especially the ones that put cash in your hands. It is also part of the reason they have deputized all cops as stick-up/highway men/thieves. Those in power want to control every aspect of your life in every way they can.

@Gadsden

Well, why wouldn’t you?

Not saying you shouldn’t

Yes, do that. Cash hand to hand is anonymous and more secure in the transaction, cryptocurrency really isn’t as anonymous or secure as its touted to be in any transaction.

Notice in these

‘sales pitches’‘articles’ from McNealy how they only highlite the imagined uses or the positive? Its all ‘recommended’ so ‘glowingly’, all the pros and none of the cons presented, broad claims that seem to give information but do not reveal the details that will show the weakness and fallacy in the claims. Obviously the articles are biased, and the guy is a ‘entrepreneur’ and one of the things ‘entrepreneurs’ do is try to get people to buy into what ever they are ‘selling’ – they are almost like one big over worded ‘advertisement commercial’.Well, as many begin to realize over time and smart people already know – if it sounds to good to be true that could very well be the case. Now is that old adage always applicable? No, not always and people learn that over time and smart people know that too.

But when you look at the claims individually for cryptocurrency and begin to scrutinize them a little more, things don’t add up to the overall ‘zeal’ at which they are promoted. For example, lets look at this broad claim frequently made for cryptocurrency :

“Digital currencies allow for peer-to-peer transactions without a third party, and this minimizes risks as well as cutting out transaction fees.”

Well, its true that cryptocurrency does allow for peer-to-peer transactions. However, “cutting out transaction fees” is not true because there can be transaction fees.

The part about “without a third party” is also not true because there is a third party in the form of the block chain record and the humans behind the cryptocurrency doing the coding and making the rules and setting conditions and dominating the cryptocurrency market.

And as for “minimizes risks”, nope. Anytime you have a financial asset in a decentralized system of transaction the risks are increased, with cryptocurrency the increased risk of scam and theft are greatly increased in many ways. Remember, cryptocurrency is a decentralized digital currency, not subject to any government or central authority and this means there are no legal intervention points as there is no place for the law to step in to supply default rules to protect the consumer.

The transaction fee thing is especially interesting. If you dig deeper into this claim for cryptocurrency you will eventually come upon a comparison to traditional banks transaction fees and the general claim that “transaction fees are low” for cryptocurrency. Huh? If the transaction fees are cut out with cryptocurrency then how can there be low transaction fees assessed for a cryptocurrency transaction? The comparison to banks with transaction fees goes like this, basically: Traditional payment systems such as banks charge anywhere from 3-10% transaction costs, crypto markets typically charge 0.5%. However this varies widely with some exchanges charging a flat rate of 1% while others using a more complex algorithm to determine the fee based on current bid/ask orders.

So its not entirely true that transaction fees are cut out, but the broad claim does not reveal that.

The claims of security and being anonymous for cryptocurrency are also not as true as they are portrayed in the broad claims for cryptocurrency.

Lets put anther aspect out there too. Founders of a cryptocurrency always have a financially vested interest to promote a cryptocurrency. This interest is to enrich them which at the basics is the real reason they want a decentralized digital currency, because there is no law to intervene with the rules they create.

I’m not saying its all a scam, sure maybe there are uses for a cryptocurrency. But its not all its promoted to be, its not as secure and anonymous as its promoted to be, overall its an area rife with scam and theft, and like any system of financial assets transactions it too will eventually be subject to the demands of economy and you will begin to see retailers beginning to charge fees for use of a cryptocurrency and subjected to the demands of government.

For those that do not know, the IRS already treats ‘virtual currency’, AKA cryptocurrency, as property for purposes of taxes > https://www.irs.gov/irb/2014-16_IRB#NOT-2014-21 … so yes you just might owe some taxes on your cryptocurrency holdings. But you need to ask yourself, how do they know? Some would say “they are relying on a persons honesty.” Yeah, you keep thinking that but consider also how does the U.S. government track a cryptocurrency back to a person then seize their cryptocurrency for crimes? Well, its because although the government doesn’t say anything about it, yet, normally for other than crime right now they do have the means.

This is patently false:

“anonymity with bitcoin transactions that supposedly makes them ‘untraceable’ back to an individual”

This is false:

“The part about “without a third party” is also not true because there is a third party in the form of the block chain record and the humans behind the cryptocurrency doing the coding and making the rules and setting conditions and dominating the cryptocurrency market.”

False again:

“Remember, cryptocurrency is a decentralized digital currency, not subject to any government or central authority”

Conflating exchange fees with blockchain transaction fees:

“So its not entirely true that transaction fees are cut out, but the broad claim does not reveal that.”

TUSC and Bitcoin were never “marketed” as anonymous or privacy coins:

“But its not all its promoted to be, its not as secure and anonymous as its promoted to be,”

Yes, you have to pay taxes with crypto, just like any other investment:

“For those that do not know, the IRS already treats ‘virtual currency’, AKA cryptocurrency, as property for purposes of taxes”

You have many incorrect ideas about crypto.

The “new” owner cashing in. Its’ BS

I’ve no idea WTH y’all are talking about and want no part of it. Stock market was shady AF and this is next level.

Seriously disappointed in TTAG pushing this junk. Anyone with true investment experience can see what’s happening here. Stay away

While i do love the idea of crypto to avoid government control and surveillance, or the idea of Bitcoin as a currency limited to 21 million units as opposed to the FEDs inflationary money printer, NFTs are kinda suspicious. They seem more like the Tulip frenzy. Without the Tulips. But you’ve got a picture of a Tulip. And it even says it’s yours. Yay.

NFT tech is far bigger and has many more applications than .jpegs. NFT art is n a hype bubble right now, no doubt. Most are garbage, some are not. It’s like when there is any gold rush. Is gold still valuable? You bet.

NFT tech is about chain of custody and probable ownership. Fractionalization and trading of NFTs of physical goods is coming. That is the real revolution that is coming. Keep your eye on that.

Max, the thought of the Dutch tulip financial ruin didn’t occur to me, but the comparison is appropriate. The three B’s are the way to go. Beans, bullion and bullets. A little currency at the beginning of things going south doesn’t hurt. You know, before everyone figures out money isn’t worth shit.

At least with the Tulips (if you took physical possession) you might grow a purty flower for you woman. Ponzi gave you some paper. The “crypto” scam??

Most crypto people I know are preppers and they have investments in across many asset classes as a hedge. I even organize a prepping conference here in Utah called OffChain.events.

If you go “all in” on any one thing, you are taking silly risks. I like bullion too, but it’s a poor performing asset. It won’t make you much money over the long term.

For the members of the “More money than brains club” I invest in precious metals, brass, lead, copper…. What other currency can buy or trade for almost anything else plus it can defend your home and life, and provide food when the ranches and stores have none. FDC (F&k Digital Currency) and FJB

You can’t buy anything online with metal.

Metal doesn’t help gun retailers with their huge payment problems right now.

Metals won’t make much money as an investment.

I thought this was a website for gun related stuff.

I know you’re pushing this to pay the bills but honesty, what kind of reaction were you expecting.

And this is from someone who actually has some crypto investments.

Well….we can finally put the nail in the coffin of this website. What used to be an interesting site for gun news has now devolved to a site pushing this type of crap. It is bad enough they pad content by using other people’s memes(most of which aren’t that funny) or post advertisements barely masquerading as serious articles. Now they post garbage content like this pushing snake oil NFTs and crypto that have nothing to do with guns or the 2nd Amendment. I’ll be removing this site from my favorites. I’ve been hoping they would pull out of this nose dive but apparently not. Seriously guys….just shut the site down and move on to something else.

This wasn’t paid content.

There is relevant tot he gun world as 2A retailers are being financially deplatformed. Crypto is a way to help them.

Regardless of your opinion about this tech, it’s here to stay and relevant to many of us in this space.

In some parts of the world, NFTs might have some use besides financial speculation.

https://www.protocol.com/nft-independent-chinese-language-media

But seriously TTAG, post on what you are competent in.

They misspelled their own article.

https://www.protocol.com/nft-indepedent-chinese-language-media

Rob is the co-fonder of a cryptocurrency. He has more than a sufficient level of competence in this area.

I think u got ratio’ed brah.

Anyone else here old enough to remember the pyramid ” investments” of the 1970’s ? …. any day now I’m fully expecting to receive my big payout of at least $25,000, I’ve gotta be ready to slide into that final top spot by now, right?

ahahahahah…seriously? Founding a cryptocurrency is quite easy. Literally any fool with a laptop and some time can do it. There are currently over 8,000. Each one created in hopes that the “greater fool” theory takes over and makes the creator millionaires. NFTs are no different. So you basically admitted the author of this article is another of these snake oil salesman who is writing articles to try to pump up the crypto market in hopes some fool buys his(and I’m assuming some of his NFTs which I’m sure he’s also “founded”). And I’m also guessing people involved in this site were either paid to post this article to pump up crypto or they themselves own some cryptos they want pumped up.

This site used to be about GUNS and the 2nd amendment. It’s now become the Zerohedge or Infowars of guns sites. I’ll be moving on as it’s become a sad joke of it’s former self.

No. I didn’t pay to post anything here.

Copying and pasting a smart contract code for a token is easy, so what? Launching a blockchain isn’t. Getting adoption of a blockchain is even harder. It takes years of working with people in the industry.

We never sold coins or tokens in our project, not ever. We have never hyped our project as an investment. We bootstrapped this project. I never tell people to buy anything, except occasionally Bitcoin.

We are trying to solve a real issue in the gun world. How about you? What have you done to help gun retailers?

Nah.

Let me start by saying I am not accusing anyone of anything here. And, that I know very little about cryptocurrency other a little general information. That said, however, just from what little I have read about it, crypto just makes me think of the Enron scam. an energy company that never produced a gallon of oil or watt of electricity. Digital currency with no tangable assets or backing. it’s worth what the programing says it’s worth and there is little recourse if something gets hacked or some virus in the system dumps the information.

Sorry, no thank you. I’ll keep my investments in real estate, gold, silver, and a few other things.Should the worst happen and things go south badly, at least we can grow our own food, and we can trade or barter for what we may need that we can’t produce.

Or, if things continue as they are now and life goes on, I can pass the land and other things on to the next generation knowing they will have something that, with care, will support them as well.

The whole point of this article was to introduce people to some new technology that is going to change a lot of things and to debunk a lot of the hype and nonsense about it.

It’s hard to scam people when you never sold them anything in the first place, then spend four years of your life doing what you said you would, on top of investing a ton money into the project, just to try and solve a huge problem for gun retailers.

Stopped all recoil magazines since the “pride” issue

They lost m

Say what you want about all the problems with the NRA: Wayne’s suits, the joke of cronies that make up the board, the waste of money on the black guy, the scandals:

They at least didn’t blatantly insult their readers of American Hunter by putting something offensive to their readers’ majority religion on the cover.

Say what you want about all the problems with the NRA: Wayne’s suits, the joke of cronies that make up the board, the waste of money on the black guy, the scandals:

They at least didn’t blatantly insult their readers of American Hunter by putting something offensive to their readers’ majority religion on the cover.

As TTAG apparently has hit rock bottom, perhaps Robert can repurchase it at a discounted price. I’d suggest TTAG is worth about 10% of what he sold it for in 201_. (IF a web forum actually has any intrinsic value).

Hi, today NFT: much more than good pictures as it is gaining momentum in use around the world and also provides a wide range of opportunities for its future if you are into art and you are interested in new sales methods, greater recognition of digital art , active communities of collectors and commissions for secondary sales. The site has a blog where you can find a lot of interesting things about art certificates of authenticity and a lot of important things.

NFTs: Much more than eye-catching artworks! Unlock the unique world of NFTs, showcasing ownership like never before. And with OWNR Wallet, enhance your cryptocurrency journey even further! OWNR is the secure, multifunctional virtual wallet app designed to simplify your crypto experience. Whether you seek a reliable tool for daily transactions or the most cost-effective way to acquire Bitcoin, OWNR has you covered. Store, exchange, receive, and send 9 coins, manage ERC-20 tokens, monitor BTC price shifts, purchase crypto & virtual currencies using a card — all within a single digital wallet, adhering to the highest security standards. Discover more:https://ownrwallet.com/

Comments are closed.