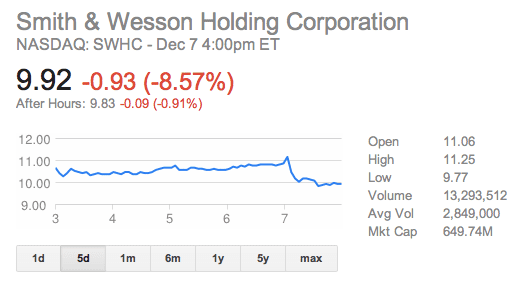

“Both Smith & Wesson and its prime rival Sturm, Ruger (NYSE: RGR ) tend to benefit every time an election rolls around, because the uncertainty of gun control gets debated in ritualistic fashion. In similar déjà vu fashion, both companies’ orders tend to taper off shortly after the elections are over, as investors realize that they’ve bid shares up far beyond the gun makers’ potential. While I’m not overly pessimistic on Smith & Wesson, I’m not overly eager to jump into the stock here, even after today’s nearly 10% tumble. For now, I’m perfectly happy being an innocent bystander and waiting on the sidelines, while keeping my eye closely on that backlog figure.” – The Motley Fool

It’s easy to see the Smith and Wesson and Sturm Ruger have strong product lines with good value. Most gun connoisseurs have multiple examples of each. Predicting the best time to buy stock in either is a much more complicated endeavor, especially if one does not have a time machine.

Their earnings were in line w expectations, which expectations were high given the recent quarter included election-related sales. This means they are humming along nicely. Not only did I buy some at $10/share, this dip provides a nice little entry for more shares.

I played the election with S&W stock. I bought 1,000 shares on Nov 1st and sold them on November 7th and pocketed a grand. If I had not been too queasy, I could have made more but I was happy with the play…

Comments are closed.