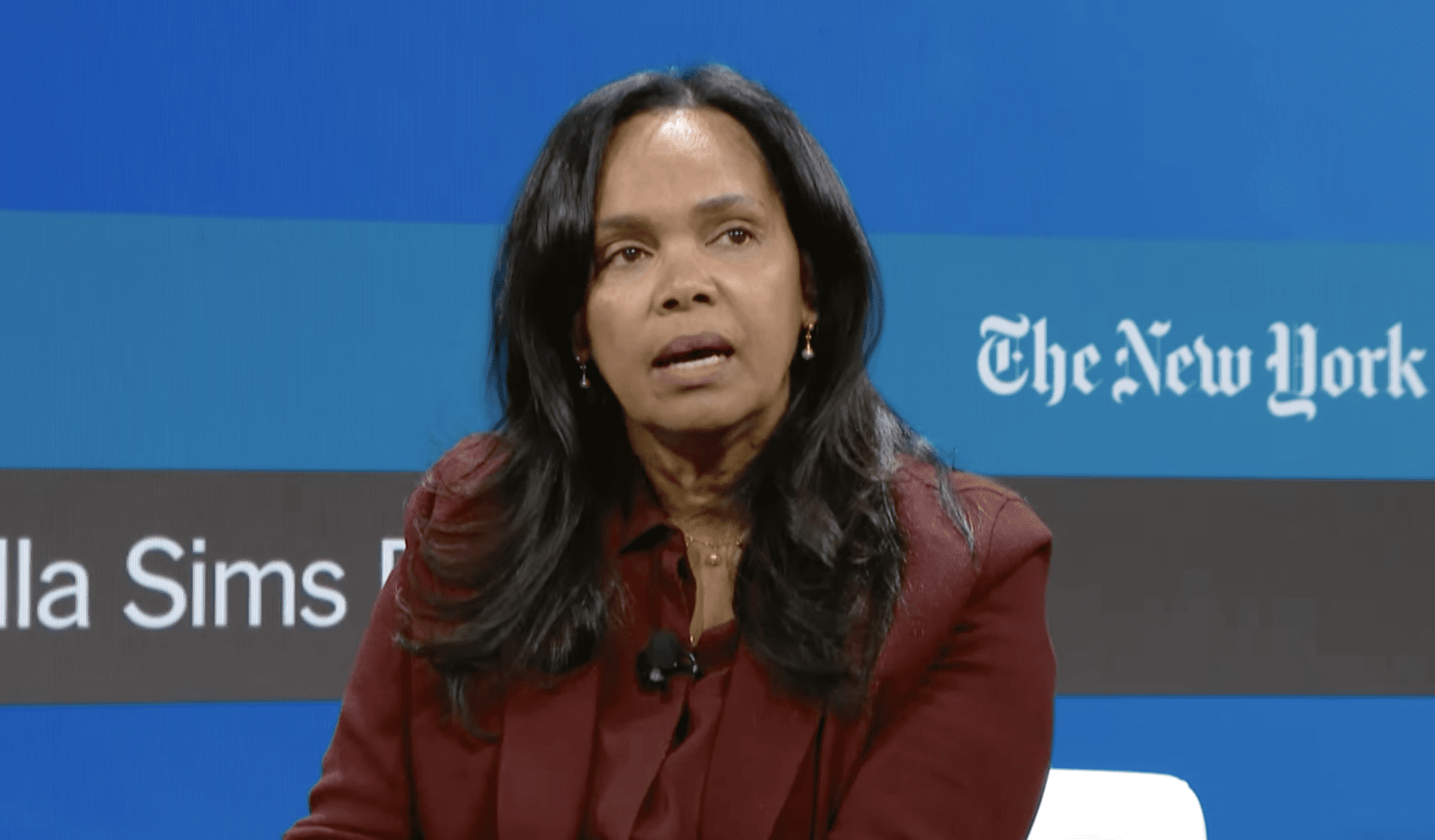

Amalgamated Bank CEO Priscilla Sims Brown isn’t shy about catering to Democratic politics and progressive causes. The New York Post even described her as “the Left’s private banker.”

Sims Brown is especially proud of herself after she lobbied the main international credit card standards organization to create a special tracking code for gun store purchases. She wants to know who’s buying what and why. It’s a ruse under the guise of stopping criminals from misusing firearms.

Fortunately for law-abiding Americans who support the Second Amendment, lawmakers at the state and federal level are saying “Not so fast,” and proposing legislation to block the tracking of such lawful purchases.

What’s In Your Shopping Cart?

Sims Brown’s goal is to have credit cards implement a special code to track purchases made by law-abiding Americans at firearm retail stores. She urged the International Organization for Standardization (ISO) to create a Merchant Category Code (MCC) and they gave in.

She spoke with New York Times columnist Andrew Ross Sorkin – a proponent of the scheme – and admitted the code is only the beginning. “We’re at the very early stages of this,” Sims Brown told Sorkin. “But as this is implemented, those scenarios will be used.”

The “scenarios” she’s talking about include “detection scenarios” in which a purchase prompts a bank to file a Suspicious Activity Report to the Treasury Department’s Financial Crimes Enforcement Network (FinCEN). There have been no guidelines on what any of that means or what purchases would be flagged.

That’s because the MCC won’t identify what is in the customer’s shopping basket. The customer could have passed an FBI National Instant Criminal Background Check (NICS) verification to lawfully buy a firearm and ammunition. Or the purchase could be for camping supplies, waders, decoys, blinds and other outdoor gear for a hunting trip. But the total cost could be flagged as “suspicious” since it might be an outlier on a customer’s purchase history.

Even Bloomberg News – owned by gun control advocate and financier Michael Bloomberg – threw cold water on the idea, saying the code wouldn’t work. “The payment network and its banking partners would have no idea if a gun-store customer is purchasing…a rifle or safety equipment.”

Credit Card CEOs Respond

The new MCC for gun store purchases was approved in September of last year so the implementation process is still under development. Still, some of the CEOs at major credit card companies are speaking up.

Discover announced it will begin using the gun store-specific code in April, becoming the first major credit card company to confirm they’ll use the code. Discover has the smallest market share of the four major credit card companies by far at about four percent and other estimates put it at just two percent, but the move is still significant.

In announcing they will use the code, a Discover spokesperson was coy. “We remain focused on continuing to protect and support lawful purchases on our network while protecting the privacy of cardholders,” said a statement. “We were following the industry for consistent implementation.”

The Discover spokesperson also let it slip that other credit card companies will roll out their MCC gun store codes. That’s Visa’s CEO Al Kelly. Yet even Kelly conceded that the new codes won’t be as effective in flagging purchases as antigun activists have claimed.

“If [Visa’s Chief Communications Officer] K.C. Kavanagh goes into a gun store and buys three thermoses and a tent, and you go in and buy a rifle and five rounds of ammunition, all I know is you both went to the same gun store… But I don’t know what you bought,” Kelly said.

On Visa’s website, a statement reads, “Many are advocating the use of MCCs to track gun sales as a potential tool in combating gun violence. That’s not what merchant codes are designed for, nor should they be.”

Mastercard and American Express have yet to comment more specifically about their plans to implement the tracking code.

Legislative Protection

There’s good news for supporters of the Second Amendment and those concerned about government agencies tracking their perfectly lawful behavior. Mississippi, West Virginia and Florida are leading the way with legislation to block the tracking scheme.

In Mississippi, a bill is pending to preclude the use of the gun store MCC. House Bill 1110 has already been approved overwhelmingly by the Mississippi House of Representatives, 87-26. The bill is expected to move swiftly through the state Senate.

In Florida, the Republican-controlled Senate Banking and Insurance Committee approved Senate Bill 214 that would target yet-to-be-enacted plans by some credit-card companies to create a gun store MCC. That bill would even fine credit card companies up to $10,000 per violation.

In West Virginia, Republican state Treasurer Riley Moore spoke of efforts to block the code as well, praising the House of Delegates for approving legislation that would ban any credit card company that tracks gun and ammunition purchases from bidding on state contracts.

There is also buzz in Washington, D.C., as efforts to block the tracking code on a federal level are gaining steam, even as Members of Congress and U.S. Senators back other efforts to ensure financial companies cannot discriminate against the lawful and Constitutionally-protected firearm industry.

Sen. Steve Daines (R-Mont.) introduced the Firearm Industry Nondiscrimination (FIND) Act that would end the ability of corporate entities from profiting from taxpayer-funded federal contracts while discriminating against a constitutionally-protected industry at the same time. The same legislation was introduced in the House of Representatives earlier this year by U.S. Rep. Jack Bergman (R-Mich.).

Also in the upper chamber, Sen. Kevin Cramer (R-N.D.) introduced the Fair Access to Banking Act, S. 293. That bill would work to end the discriminatory lending practices of major banking institutions that seek to circumvent the legislative process and set social policy from the boardroom.

As these legislative efforts continue to block boardroom gun control, NSSF will be watching closely.

Larry Keane is SVP for Government and Public Affairs, Assistant Secretary and General Counsel of the National Shooting Sports Foundation.

My purchases are none of their business.

Says who? Not saying you are wrong just that you may not be permitted to be correct without a lot of legal pressure.

Sadly you are using their card as a line of credit…You have to go by their terms and conditions you sign up for (nobody reads)…. So really it is their business…I don’t like it anymore than you do…

It is not any of their business. The company is not paying you. You are paying the company with interest. Their terms do not matter when what they are up to is nothing more than another backdoor Gun Control scheme. And where there is Gun Control there is discrimination, etc. They cannot wiggle out of that.

You are using THEIR card… Read the fine print… They can pull you credit at anytime… and report you if they want….

No, it isn’t their business for your lawful purchases. Its only, by law, their business if its unlawful purchases.

I’ve never purchased a gun or ammo online. Always in person, and always with cash (and in CA, never within this State since the ammo BGC went into effect in 2019). A few parts or replacement components, sure…there’s almost no way around that nowadays. But anything registerable or identifiable as a firearm? No way.

Depending on components purchased a profile of likely owned firearms could be assembled but they would be digging through your emails at that point.

Sometimes interstate vendors may be the only suppliers of some items at good prices.

You’re already on one of the higher ranked enemies list because you post to this site.

If you think you’ve covered your tracks coming here you’ve probably certainly slipped at some point or another.

Hiding from NSA and related agencies was bordering on impractical if not impossible a decade ago and I am sure they have upgraded their tech since. With that said if most of this site is on their high priority target list then the world is a far safer place than I saw. Now various lefty groups yes they would love to get info for doxxing and other less than legal purposes but as long as the government does not directly supply them with their information they can have a difficult time connecting names with professions especially when they suck at playing two truths and a lie.

So if a state, such as Florida, enacts legislation prohibiting their banks from doing this, would a person in another state be able to open a credit card account with that Florida bank and be protected?

Which credit processor would it use? Discover MasterCard visa or Amex?

I don’t think it would matter, if Florida passes a law forbidding the action. California sure likes to pass laws telling the rest of the country what they must and must not do, why can’t Florida (or other states) do the same?

Optimistically when the processors run into resistance and legal action they will cut their losses instead of pushing forward. We shall see but at the moment they are the credit industry with no viable by scale alternatives.

“But the total cost could be flagged as “suspicious” since it might be an outlier on a customer’s purchase history.”

It smells like a ripe opportunity for a class-action lawsuit to me…

Patriot Act could provide cover

People need to stop using the cards as much as humanly possible anyway…Most businesses are charging 3%-5% for using the cards as “service fee”…The card companies are charging them to process your purchase and receive their payments…Companies are being forced to charge this or either mark up the price of their products….A lot of places give cash discounts for not using a card…People are giving away hundreds of free dollars a year just to use that card…I pay mine in full every month so credit card companies hate people like me…

Businesses are not supposed to charge extra for credit cards, it goes against the agreements they sign with the credit card companies.

Look at Gunbroker… 3 to 5 percent to use a card… look at your receipts when you buy in some places… a service fee item on the total cost is what that is… the credit card companies are charging them to process payments on credit cards purchases… very few companies absorb those cost..

All of my “gun” purchases are “suspicious” since they happen so infrequently.

Use cash – or gold bullion only

Silver too…it will be the currency of choice in the apocalypse

Something tells me food and antibiotics will place higher.

Silver won’t fix your infection because you stubbed your toe in the apocalypse.

Cash is King…until they take that away from us too.

Welcome to social credit folks

What you thought social media was for your benefit?

Pretty sure that today’s surveillance-society tracks much more than just social media (air travel, endless facial recognition, postal mail recording, “data brokers” doxing everyone, etc.).

Where do you think they get a lot of the data for such tracking initially?

Just tell them everything is an “AR-15.”

Especially the non-firearm stuff.

GIGO.

In reality once the primitive codes are implemented far more sophisticated codes will follow which will indeed transmit the information directly to a police department if you are a felon who just bought ammunition. All this would be a godsend to law enforcement.

And it will also make a record of a firearms purchase which is done by a law abiding citizen because in the future if such a citizen commits a crime its evidence you were in possession of a firearm. Again a godsend for law enforcement.

If in the future there is a ban on assault rifles the Feds will have a way to find out if you are still in possession of one simply because you were still buying ammo for the banned weapon.

Ford just announced that the newer self driving cars will attack you with loud noises and limit how far you can drive if you miss a car payment and after that 1st warning the robot car will drive themselves to the nearest repo center.

The new robot cars will also be capable of never exceeding the speed limit either or driving through a red light which will save thousands of lives as well as getting rid of dead beat Hillbillies that do not make car payments.

On Holidays there will be a lottery that will limit the amount of cars on the road to avoid traffic deaths and eliminate the need to build more and more highways as the population grows.

People will be forced more and more to use mass transit which will eventually wean them off of the need and even the right to own an automobile to lessen the greenhouse gas effect as well as reduce traffic deaths. Eventually only electric vehicles of all types will be allowed on the highways.

The new Socialist Utopia will have more advantages than disadvantages when it comes to controlling human behavior.

😂

Phony dacian is good for a laugh. Real dacian is a god send to the pro gun side.

And phony D puts in more effort which we should appreciate.

Godsend, dacy-anne? God sent your daddy to hell for fathering you.

tl;dr

There are bolt action rifles that use 5.56,.223,7.62×51,.308, so trying to use Ammo as a GUIDE will “NOT WORK”!!!!

We currently have 2 pieces of legislation in Iowa working their way through the state Senate and Legislature. SSB1094 and HSB 180 that will keep the state from investing in any company that uses these type of tactics against any company that does business legally in the state.

How ’bout another code? We need a code that identifies people making purchases that enable First Amendment rights. We need to identify Jews, Moslems, Christians, Hindi, and everyone else who might oppose the New World Order. We can’t abolish free speech or the freedom of religion – yet – but we should be able to track those people!

Banks own the world.

Senator Daines (R) is a pretty good Joe. He is trying to stem the attacks on the Constitution…Montana is mostly proud of him.

…and then…

…there is our other Senator, Jon Tester (D), two Senate election cycles in a row he was the largest recipient of out-of-State Democrat Dark Monies out of all Members of Congress. He is a schmaltzy prostitute to Democrat money…oh, yeah, and to their Progressive Agenda. He has not met a radical Democrat scheme that he hasn’t voted for then sent out an e-mail explaining how he “had” to F’ everybody royally cause it was the “right” thing to do.

There is a big difference between a “Gun Store Purchase” and “purchasing a firearm”. If I were to go into a “gun store” and buy replacement arrows for my hunting bow and maybe some camo, that could be flagged as a “gun store purchase”. That is not a firearm or firearm component. When these bugger-eating-morons finally do ban guns, will they come after my bow next? Pretty sure it isn’t covered by the Second Amendment.

Indeed it is covered. “Arms” do not specify firearms. My guns, knives and bows are covered by 2a.

Technically so are nukes. Technically. I don’t think the 2A is necessarily limited to small arms, although that is a somewhat common interpretation.

The answer is right in the Larry Keane article but then he brings up SARS and FinCEN :

Stores like Bass Pro, Cabelas, Academy, Scheels and even hardware stores in rural areas all sell guns and ammo but sell a lot of other things. What if the MCC code is for a box of lag bolts or a bicycle?

The problem with the article is what triggers a SARs report and the involvement of FinCEN.

I have never even heard of a SARs report being filed for under $10,000 aggregate. Over $10,000 is which would be be structuring and that is illegal. Purchasing a gun legally is not and isn’t a FinCEN issue.

“The merchant used the wrong MCC code”. OK I didn’t know, it’s not on any paperwork I have.

“Sorry to have wasted your time.”

Think if they implemented a code for paying for an abortion. The left would be protesting in the streets that the big corporations were tracking their murder choices.

100% on the money right there. Is there a code for purchasing drugs?

“The Discover spokesperson also let it slip that other credit card companies will roll out their MCC gun store codes. ”

Sounds a lot like collusion and a RICO.

we should hold the credit card companies liable for any crimes committed using said firearms purchased using their credit card since they blatantly think law abiding citizens are up to no good.