On Tuesday, Oct. 18th, Missouri Attorney General Scott Fitzpatrick divested $500 million in assets managed by the massive investment management firm BlackRock on behalf of the Missouri State Employees’ Retirement System (MOSERS). AG Fitzpatrick criticized BlackRock’s blind commitment to environmental, social, and governance (ESG) principles, noting that “fiduciary duty must remain the top priority for investment managers—a duty some of them have abdicated in favor of forcing a left-wing social and political agenda that has failed to succeed legislatively, on publicly traded companies.”

A relatively new group, the State Financial Officers Foundation (SFOF), has also taken action against ESG-obsessed investment management firms and strategies. South Carolina’s treasurer Curtis Loftis said he would remove $200 million of state retirement funds from BlackRock control by December.

Louisiana’s treasurer John Schroder told Financial Times that he would divest $794 million from BlackRock as well. Additionally, Utah and Arkansas committed to pull $100 million and $125 million, respectively, from BlackRock over concerns that the firm prioritizes ESG principles over sound fiduciary management of state funds.

Utah’s State Treasurer Marlo Oaks said, “We need to ensure that the money is not being used to drive a separate agenda different from our obligation” to maximize benefits to Utah residents, not left-wing climate agendas.

Legal Look

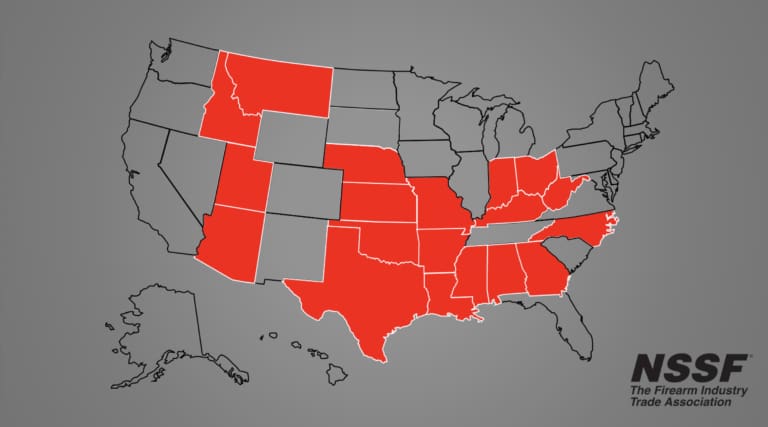

The ESG pushback doesn’t end there. In early August, 19 state attorneys general (AG) sent a joint letter to BlackRock CEO Larry Fink voicing similar concerns that the company’s ESG agenda hampers its ability to deliver a maximum return on investment (ROI) for its shareholders.

Given BlackRock’s substantial influence in the investment management industry, state-level officials describe the firm’s wholesale commitment to leftist ideals as antidemocratic, irresponsible, opportunistic and possibly even illegal under various state laws.

“Rather than being a spectator betting on the game,” the AGs write, “BlackRock appears to have put on a quarterback jersey and actively taken the field. As a firm, BlackRock has committed to implementing an ESG engagement and voting strategy across all assets under management, and held over 2,300 company engagements on climate, the most of any category of engagement.”

Targeting the Firearm Industry

The firearm industry is no stranger to corporate liberalism run amuck. The past few years saw some of the nation’s largest banks and financial institutions generate “woke” policies targeting firearm and ammunition manufacturers. Specifically, JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo have all adopted discriminatory policies unfairly denying financial services to firearm-related businesses simply because they don’t like the overwhelmingly popular firearms that these American companies lawfully make.

Like Blackrock, these banks have shirked their fiduciary responsibilities in favor of pressuring legal firearm manufacturers to not make, for example, modern sporting rifles (MSRs). The audacity for these companies to circumvent current law and roleplay as an elected lawmaker is as astounding as it is insulting.

Even more recently, credit card companies American Express, Mastercard, and Visa announced in September that they would implement a new merchant code that singles out individuals who make a purchase at any Federal Firearms Licensee (FFL.) A lot of Republicans and those in the firearm industry recognize this for what it is: financial institutions with woke boardrooms carrying water for progressives who are perfectly happy to vilify legal gun owners and American businesses through a “big brother” style surveillance operation.

Dedicated AG’s who sent the letter to Larry Fink, those state officials that make up the SFOF, and politicians like U.S. Sen. Kevin Cramer (R-N.D), who introduced the Fair Access to Banking Act, are making strides in fighting back against ESG and woke corporate boardrooms, but we ultimately need more lawmakers to realize that they cannot let corporations do their job for them and dictate laws to the American public.

Larry Keane is SVP for Government and Public Affairs, Assistant Secretary and General Counsel of the National Shooting Sports Foundation.

Even if Blackrock wasn’t filled with “Woke Dopes”, they have huge exposure in the Chinese Real Estate Market and China in general and are basically trapped financially. getting capital out of that firm is really smart. Blackrock may not survive as a company.

Government TSP program and Vanguard should keep it afloat.

too big to fail.

corporate America used to be the exclusive domain of the republicans…not anymore…

“…they have huge exposure in the Chinese Real Estate Market and China in general and are basically trapped financially.”

What did the mortgage finance companies do in the early 2000s when they discovered their portfolios were crammed full of sub-prime loans teetering on the brink of default?

Instead of manning up, taking responsibility for their stupidity and eating their losses, they re-packaged the bad loans with regular mortgage loans and re-sold them as being good loans. The end result? The 2008 economic collapse.

The conscious act of hiding screw-ups is what little kids do when they do something wrong. And guess what? What happened in the early 2000s is now happening, all over again.

There’s an absolutely fascinating 2015 movie about that subject, and well-worth the watch called ‘The Big Short’. (In finance, ‘shorting’ something is making a financial bet the value of what you are ‘shorting’ will go down in value. The lower in value it goes, the more money you will gain. Consequentially, if it rises in value, the more you owe who you made the bet with) :

https://movies2watch.tv/movie/watch-the-big-short-hd-18698

Here is on who hopes they do founder and sink. They may well have to divest themselves of major amounts of land they’ve bought to hold for profit. I seem to remember hearing recently they are the second largest holder of agricultural land after Billy the Gates. I do NOT trust their judgement nor their policies with respect to farmland and farming as an activity. I’d far rather see that land in the hands of smaller holders who value it for the land it is, and will use it responsibly rather than buy-and-hold schemes hoping for an YUUUGE increase in price.

You mean people would rather invest to make money rather than to virtue signal action on existential causes for their cocktail party friends?

Who’da thunk it?

I’d eagerly welcome cataclysmic destruction to the economy, nation or planet if I thought it would drag these elitist schmucks down a peg but we all know they’ll be insulated from any ill affects while the rest of us peasant Sims suffer for the choices they’ve made playing this game.

Approve or not your hard times stimulas check went to environmental wackos who in turn funneled your money to democRats. And include those checks promised to offset senseless, insane gasoline cost, etc. But not to worry this winter freezing people who cannot afford heating oil can burn their furniture in a 55 gallon drum.

“Approve or not your hard times stimulas check went to environmental wackos who in turn funneled your money to democRats.”

I bought my Ruger LCR in .357 with my ‘stimulus’ check, just to piss off the Leftist Scum ™… 🙂

got a Shockwave just for the hell of it…hope O’l Joe will let me keep it….

Esg sounds like the mark of the beast to me. Sounds a lot like one world government. We are running things, if you don’t have the right esg score you won’t buy or sell. Best check the clock, see what time it is.

Redneck.45lc,

While ESG may not be the mark of the beast, I have to think that it is the precursor to the mark of the beast.

The sad reality in our world is a perversion of the Bible’s Golden Rule. That perverted version of the Golden Rule is, “He who has the gold makes the rules.”

An investment company which controls 9 trillion dollars is a behemoth. I have to imagine that they are quite literally able to do anything–and I mean ANYTHING–they want.

Aside from Divine intervention to constrain the likes of BlackRock, I don’t know if there is a way to constrain them. Even “solutions” involving the cartridge box are likely to fail when the likes of BlackRock can hire 100s of thousands of mercenaries to carry out their bidding.

Scott Adams, creator of the Dilbert strip, was cancelled for ridiculing corporate ESG scores.

How about do onto others as they would do onto you, but do it first.

“Esg sounds like the mark of the beast to me.”

Close.

What the Leftist Scum ™ fail to realize, ESG is nothing more than the Chinese ‘Social Credit’ system, and they intend to fully leverage it against those who won’t “get with the program”.

(Translation – Anyone who doesn’t think exactly as they do. Use your imagination as to who ‘those people’ are… 🙁 )

Watch authoritarian trends in China to see what’s on the way here.

A group of Foxconn workers escaped lockdown and are walking home. They broke out when they discovered coworker’s in another room were all found to be dead. Foxconn’s working conditions are said to be worse than labor camps.

BlackRock manages about 9 trillion dollars–BlackRock could not give a $hit less if some states pull a few billion dollars out of BlackRock’s portfolio. Note that a few billion dollars is less than 0.1% of BlackRock’s portfolio.

Remember, all that represents as a loss to BlackRock is whatever commission they would make on that investment money. If the states yanked 7 billion dollars and BlackRock’s commission on that money was 2%, then BlackRock would only be losing 140 million dollars. That isn’t even a rounding error on their balance sheets or income statements in their realm.

It’s good to get the word out.

We made three critical mistakes in this country:

1. We let the financial institutions tell us “We are here to protect your money. Here is our version of doing that.”

2. We let politicians tell us “We are here to protect you. Here is our version of doing that.”

3. We let the media tell us “We are here to protect the truth. Here is our version of doing that.”

But our biggest mistake; We let all three gang up on us and decide to run things.

How it should have been:

To the financial institutions we should have said: “Its our money, you will do with it as we say.”

To the politicians we should have said: “You work for us. You will do as we say.”

To the media we should have said: “You will report the truth at all times and not your version of it.”

No, we only made one mistake. Not requiring acceptable passage of an IQ test before being able to vote

“We let the financial institutions tell us “We are here to protect your money. Here is our version of doing that.””

Used responsibly, credit can literally save someone from bankruptcy and financial ruin. (An expensive car repair the household breadwinner needs to get to work, for example.)

The problem is, there are those who never learned or had instilled into them a sense of financial responsibility. The Leftist Scum ™ leverage that fully to their advantage, and make society bow at their feet.

We say, fuck that noise. Maybe this country needs a reminder of who it actually is works for who… 🙂

Greed and corruption almost sounds quaint compared to the Marxist takeover of our institutions.

WHEW , THANKS ON ARTICLE , WONDER IF CAN EVEN WORK FOR A LVING NOW ADAYS

If woke is racist, there’s nothing more woke than the Reagan “tough on crime” types, and red states have that in spades.

“Marihuana influences Negroes to look at white people in the eye, step on white men’s shadows and look at a white woman twice.” ~ Harry J. Anslinger

Just say no. (…to the back door gun control loved by all closet socialists; feeding Biden his gun control statistics despite alcohol prohibition and NFA)

Good. financial pushback is the only option here, especially with fiduciary agents.

“…financial pushback is the only option here, especially with fiduciary agents.”

A parallel economy is mostly a fantasy. Fuck that ‘separate but equal bullshit. Oh, they would *love* for that to happen. Slam the door shut on the sister-fucking inbred ‘unclean ones’.

What needs to happen is that we need to force our seat at that table, whether they like it or not. Civil rights don’t happen without force. The late 1700s and the mid 1960s were examples of that… 🙂

Demonstrating your principals using other peoples money.

It’s easier that way, right? How do you feel about fighting an enemy using s o m e o n e else’s country?

(spaced to avoid moderation)

One of Vlad’s 10-kopek army? Don’t worry, you’ll be heading on a Black Sea holiday in the next few weeks.

Georgia is practically in my back yard. 😉

Now this is what government is for. To protect of Rights of law-abiding citizens, from enemies foreign and domestic. And yes our government should be a lot smaller. But there are far too many people who want “free” condoms, “free” s3x change operations, “free” farm subsidies, “free” marijuana. These are some of the many reasons why our government has grown so large.

THE TRUTH starts with ‘Hundreds of Million’ and not “Hundreds of Billions.’

Good. Fuck ESG, it’s a hostile takeover by commies to undermine the financial system.

The truly irksome part being that most of the AUM for companies like Vanguard, Blackrock or State Street isn’t even their money. They’re “managing” retirement portfolios.

Getting fucked and paying twice for the privilege. Kinda exactly like taxes these days. The major difference being that the execs at these companies work in skyscrapers from which they can unceremoniously defenestrated.

When people realize how many ways they’re truly getting fucked via manipulation the “banquet of consequences” is gonna be bloody as fuck. You might even need to learn some French.

Things keep on this course and I suspect round one starts in about a month and a half when diesel goes from a problem to a crisis that requires “expert management”. The inflationary consequences of which… well, I wouldn’t dress nice in a city at that point, just sayin’.

He himself decided to get interested in investments and understand cryptocurrencies, maybe work on cryptocurrency marketplaces or wallets. Found https://icoholder.com/blog/how-to-make-money-with-cryptocurrency/ on the site you can find project ratings, ICO statistics, and expert reviews in the field of cryptocurrencies. The platform also offers tools for investors that help find information about projects, calculate possible returns and risks

Comments are closed.