Reader John D. Dingell III writes:

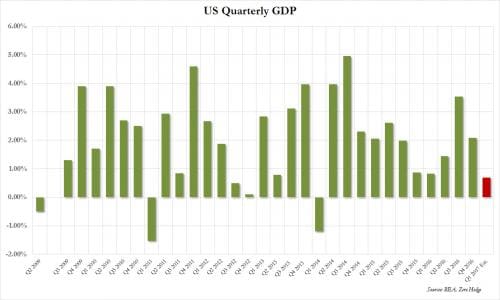

Not mentioned in the discussion over firearms sales in America is the overall state of the economy. The U.S. Bureau of Economic Analysis just posted their first estimate of 2017 Q1 GDP growth and it’s anemic, to put it mildly.

It should be noted that Q1 GDP growth is usually the lowest of any quarter due to post Christmas inventory trimming, but 2017 Q1 GDP growth was the lowest since 2014 Q1 (which was a decline). The real softness in the 2017 Q1 GDP print was in personal consumption (PCE).

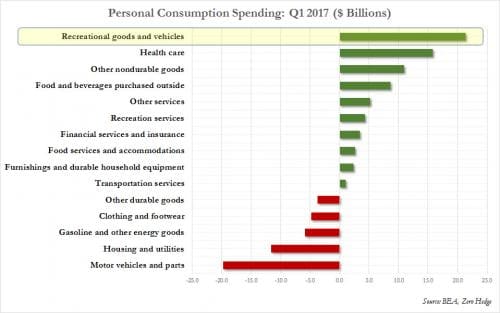

Sporting goods, including firearms, are in the ‘Other Durable Goods’ category. Ammunition is in ‘Other Nondurable Goods’.

It looks like health care expenses, no doubt helped along by soaring ObamaCare costs, are more than offsetting gains from lower energy and housing costs. The Recreational Goods and Vehicles increase is probably an artifact, reflecting dealers stocking up for what they expect will be a strong summer selling season.

Even though personal consumption reflects goods ultimately sold to individuals, much of the PCE dollar values reported by the BEA is actually supply chain sales.

Recent data prints suggest that 2017 Q1 GDP growth will be revised yet lower and may even go negative. So the jury is still out on a structural decline in firearms and ammunition sales.

These numbers are generated by leftist Pointy-Headed Bureaucrats, so I don’t trust them to be very accurate. The equity markets have had a great earnings season so far for the 1st Quarter so something doesn’t add up.

The spiraling increases in health care are caused by Obamacare and the fact that 90% of the people getting free or heavily-subsidized coverage have very expensive to treat diseases that the paying customers have to foot the bill for.

The equity markets are terrible indicators of anything other that people’s perceptions of future growth. It doesn’t reflect the middle class economy at all. Just large mainly multinational corporations. The market and the divide between rich and poor sky rocketed over the last eight years as the market gained and middle class wages were stagnant at best. And unfortunately the average American just doesn’t have much in the markets. People really should but they just don’t. Our economy is so dynamic if anyone understood it we wouldn’t have anything too worry about.

The equity market is an indicator of what happened to the “quantitative easing” of administrations past. The money, created out of thin air bye the Fed, was fed into financial markets; banks, Goldman Sacs, etc. They bought into the stock market in various ways because there was no other place to put it. Stock prices today have little bearing on the real value of the companies involved.

If the money had been invested into the working economy it might have actually done some good.

We are now sitting on a huge market bubble that will burst at any time. The only reason it has not burst yet is because investors “believe”. When they lose faith the market will fall off a cliff and we will all suffer for it. Billions, (trillions?) will be destroyed in a short time.

If you can come up with a good idea to miss the fall, Be Prepared!

Doing my bit for gun sales. It seems pretty healthy around here(IL and NW IND)…

The economy is not doing nearly as well as the last President claimed it was.

It’s actually rather precarious. As for money spent on guns, we’re just catching our breath after being scared sh!tless we would have had the HildaBeast in charge…

Gun and ammo prices here in Wisconsin are still quite steep.. retail prices are close to MSRP on most everything. Second-hand gun prices often exceed MSRP. Gun shows, same deal. Your best bet is to order online and in bulk. Buy your gun online and ship it through a FFL who won’t gouge you. Avoid the big-box stores until you compare the price on whatever you’re looking to buy.

You Sir, are getting screwed if you haven’t seen a drop off in prices the last couple of months. The deals are out there, you just have to look a bit. AR prices keep dropping and the mail in rebates on pistols are smoking good deals. As I have said before, a great time to be a buyer, a Retailer–not so much.

I always seem to help ammo sales. I’ve been buying parts here and there on sales. I just updated a BCM upper I’ve had for a decade. Replaced the 16oz 12″ DD “lite rail” meat grinder with an 8oz 9″ YHM Mlok rail and YHM flipup gasblock front sight with lug. Put some new furniture and AFG and lost about 10oz off the gun! Just between the lighter furniture, rail and a WMD NIB semiauto carrier. Reused the same bolt as the bolt and barrel have developed a good relationship over the years. It’s like a new gun!

I don’t care about NICS checks and GDP growth charts produced by pointy head economists, Gander Mtn is closing all it’s stores. Cabelas is trying to self themselves to Bass Pro. The huge Field & Stream (Dick’s spinoff) store here closed last September. My rifle smith is just before closing up shop for good. Went to my LGS last week to p/u a transfer, I was the only customer there. Ammo at pre Clinton prices. S&W giving away pistols. AR’s for $400 out the door. The gun and ammo business is doing just great. Great for consumers, not so great for manufacturers and shareholders.

On the bright side, now I’m even seeing .22 mag. on the shelf. If everything stays relatively stable through the end of summer maybe prices will even drop a bit.

Brick and mortar retail is tanking hard, and it’s not going to stop. Online shopping is the most destructive force that retail has seen in a long time, led by Amazon.

Once the malls all over America start to fall like leaves in Autumn, that’s when the real agony will begin.

Gun stores are likely to be survivors. Unless the world turns over, buying a gun will still require a trip to a gun store.

My two local Mom and Pop gun stores closed, one a year and a half ago, one a few months ago. In both cases, I’d say it was the owner’s fault, they seemed to lack interest in running a business. Closing early, or let the sales kid there alone, and, usually, the sales kid was not knowledgeable, especially the last store.

If I’m willing to travel for 45 minutes or more, I know that one locally owned store has moved from a lousy location, to a larger, up front, store, on the main highway, Another had the same type of sales kid, we went because of a promotion. Sales kid was chatting with another, took his time to finish to wait on me, then I saw him ask the boss/manager (?) if they were gonna close early. Hmm, they had the N. Texas H&K Rep there with a 20 percent off sale for the weekend, who had heavily advertised. I did hear the boss say “NO!!!”. I’m not sure I’d make that drive again, without checking if they were gonna be open for the time it takes us to get there. We didn’t buy, really weren’t planning to, but were looking to come back, when we were a little more flush.

I just ordered a gun from my local gun range, I’m waiting to see how that goes. Did my homework, no other location in the D-FW area was offering at a lower price, nothing lower on-line, either. The gun range has usually priced themselves a little higher than others, but not this time.

As for ammo, I order on-line, in bulk. I fill in at the local big box, if needed. If desperate, I buy at the gun range. Like buying milk at the convenience store. Ya really got to need it, at those prices.

most of the Demonic-crats are doom and gloomers who want a perfect world around them taking for granted the rights and privileges of this country and can’t get it through their heads that we will never achieve Utopia on this Earth or that Our Government leaders are Idiots and do not have the common sense of a Jackass which by the way is the Minority party’s symbol! Most Americans are a pragmatic people, and cannot take the time to worry about BS theories and conjecture about what is and is not and probably do not care,

Honestly, does anyone know of a gun store who is not owned by or run by dicks?

In mid-Michigan I can’t even begin to list the ones who are a-holes, even the ones who have a great inventory and prices. Add in the ones who don’t give legitimate CPL classes…

Comments are closed.