In the latest turn of events in the Freedom Group bid situation, grandviewoutdoors.com reports that they’ve obtained an internal Remington memo from George Kollitides to all Remington employees. In a bid to calm internal nerves, the CEO called GDSI’s bid nothing more than an underfunded “publicity stunt” that’s barely worthy of their time . . .

“A small, unknown investment entity publicly announced its desire to acquire the Remington Outdoor Company,” the memo obtained by Grand View Outdoors says. “If this wasn’t disruptive to our employees and customers, we would not acknowledge the news and recognize it for what it is: a publicity stunt from an agenda-driven group with no credible financing options.”

And George doesn’t think much of GDSI’s strategic vision, either.

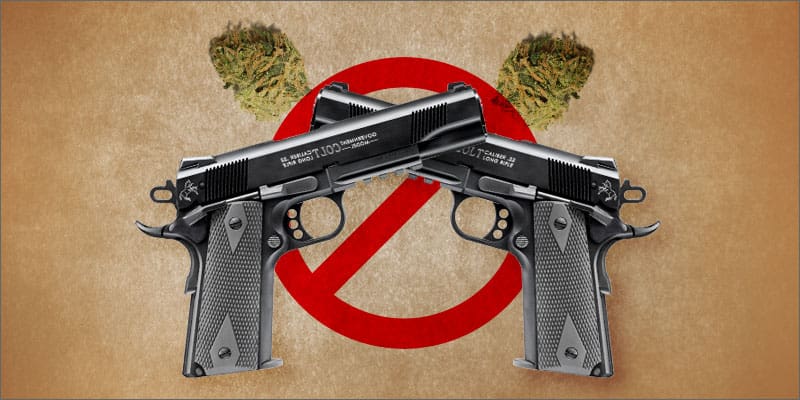

“Further evidence of [Global Digital Solutions’] misguided agenda is all over the entity’s website that displays logos of every major firearms maker and lays out a mission to introduce smart gun technology to the industry; something the consumer doesn’t want,” Remington’s internal memo says.

We’ve since spoken to GDSI CEO Dick Sullivan who called what was said in the Remington memo “disappointing.” He also pointed out that despite the company’s small market capitalization (about $100 million) given the people involved at GDSI and their resources, he isn’t worried about financing.

Sullivan said he sees Remington as a “great company” and a “wonderful icon brand,” one which GDSI can help build even further.

Stay tuned.

I’m not going to claim prescience or anything, but I did wonder about the viability of this from the beginning, since every story seemed to prominently mention that it was an “unsolicited purchase offer” from GDSI.

I’m hoping for some attempt at a hostile takeover. Is Cerberus Group publicly traded?

That would be like a hostile takeover of Labatt’s by Bill and Doug Mackenzie.

Well, if you find a mouse in your beer, what else is a hoser to do?

Take off!

Well, if you find a mouse in your beer, what else is a hoser to do?

Make him spit out whatever he drank…

I don’t know about that, those guys are pretty bad a$$. They can drink an industrial storage tank full of beer and piss out a warehouse fire, and they have fun by electrocuting each other. Plus they have a flying dog and the ability to weaponize a jar of moths.

Cerberus is not a public company.

Let’s also not forget the non starter Armatix fiasco.

I’m not too surprised. Hostile takeovers are still a thing, but apparently just voicing the possibility of such an action is delicious free marketing time these days.

[source: Putin’s Russia vis a vis the Crimea and Ukraine, GDSI and Freedom Group]

Also, ‘Freedom Group’ gives me such an Amurricah boner. Maybe GDSI needs to rebrand themselves as “Liberty International” and try again.

A “hostile takeover” can’t occur to a private company, only a public company. “Hostile” means against the will of the current board of directors and management and involves turning the shareholders against management. Since the shareholders of a private company ARE the management, they can’t turn on themselves and any “takeover” requires their consent.

A company CEO would not speak this way if a buy out was a realistic possibility.

Hostile takeovers are generally possible only when the target company is publically traded.

The Freedom Group is owned by Cerberus Capital Management (thanks Wikipedia!), a limited partnership. So the Freedom Group itself cant be a hostile takeover target. Cerberus itself does not appear to be oublically traded, from a phone search on yahoo! Finance. So that’s out too.

Best guess? Cerberus announced in late 2012 its intention of selling or liquidating Freedom Group. Not much seems to have happened since then. So my take is simply that GDSI made their offer to see how serious Cerberus really is about offloading Freedom, and if they are, to start to establish a dialog.

And in other news the sky is blue…

I’ve heard that the firm’s website is has a graphic littered with all sorts of gun companies such as Remington, Marlin, Bushmaster… and Colt, HK, Springfield, and Sig. You know, companies that aren’t actually part of Freedom Group. So yeah, sounds like bull caca.

Well, looks like the publicity stock has worked out for GDSI. They’re normal volume of traded stock is 36K, they’re already at 101K according to Market Watch.

I called it in the earlier post. Based on my experience, there was no financing. Cerberus is private and not subject to a hostile take over threat. They are well paid wall street whores. If the deal made sense and would generate a nice profit for their clients (and themselves), it would close. But unless there is financing, it ain’t worth the time of putting the outside counsel deal team on the clock . . . . . oh well.

Now if we can only trace the GDSI leadership through campaign donations or contributions to certain liberal causes, we can point the fingers at Shannon and Bloomy.. . . . . this is a riot.

Namely Sullivan and one other person?

Before GDSI (or anybody else for that matter) decides they are going to spend a bunch of money to buy their way into an existing brand and revolutionize it they might want to take a good hard look at what happened to S&W in the early 2000’s under Tomkins. All they would likely do is drive a legend into bankruptcy and end up selling it as a loss. Hopefully to somebody with substance between their ears.

“drive a legend into bankruptcy and end up selling it as a loss”

Who needs GDSI for that? That project is already underway at Freedom Group…

This is all nothing more than a stunt

Stupid stuff

It’s not stupid if you have a block of GDSI you want to dump. Watch their movement today.

Smells like a pump and dump from GDSI, in regards to their stock price. We shall see.

Up next: GDSI announces potential acquisition by Apple to bolster their secretive rumored iGun efforts. GDSI stock surges to nearly $1/share on the rumor.

*snort*

Tough to buy a firearms manufacturer these days. Their business is hot and any asking price would be at a huge premium.

“He also pointed out that despite the company’s small market capitalization (about $100 million) given the people involved at GDSI and their resources, he isn’t worried about financing. ”

If true, this is the scariest info to come out of this mess.

Where are the pro-2A billionaires pumping up peoples RKBA with their money? I can’t think of any, but can readily bring a handful on the other side of things to mind…

The only billions being pumped into this deal are missing the “illion”.

In other news, Moms Demand Action has announced their offer to purchase Sturm, Ruger,& Co., for an estimated $400K and an inventory of assorted MAIG tee-shirts and posters, most in XXL sizes. Details at 11.

Do you think that any of those XXL “T” shirts are tall sizes? Just wondering, it is so hard to get clothing that fits a guy my size. (KIDDING!)

$400K ? That’s it? Say what you will about Ruger quality, but they’re worth loads more than that. Easily.

How ’bout $400K and a night on the town with Watts on Bloomy’s dime?

I’ve looked into GDSI more.

The more I see, the more “interesting” stuff I’m finding.

The people behind this charade will rue the day that they drew attention upon themselves. They had a nice gig going – lots of government contracts, former political hacks on the board to help steer contracts towards them, shell corporations set up to play accounting games, etc. Now they’re attracted the interest of gun rights people, who don’t forget and rarely forgive, and the sort of investigation and furious interest that gun rights people bring to threats will not produce the sort of PR that GDSI likes.

The fact that GDSI is much smaller than TFG is irrelevant. For example, when Capital Cities took over ABC, it was 1/4 the size of the acquired company. It’s not unusual. What counts is whether GDSI has the financing to do the deal.

According to TFG, the deal is “underfunded.” I’m not sure what that means.

Let’s say that they were able to peddle enough paper to finance the deal. How would they service the debt? That’s what I don’t see. The gun industry’s margins aren’t fat enough to allow for the level of debt they’d have to take on to make this fly. No, they’d have to take apart and sell lots of the properties that TFG has put together, and they’d have to get a premium for those parts and pieces.

DG, the sum of the parts may be worth more than the whole. I don’t know. Also, the financing need not be all debt, but might be debt and equity or no debt at all. If the equity financers are thinking long term, the deal might debt service or might not have to for a long time. This is a strategic acquisition, not a financial acquisition.

There would be a lot of moving parts to a deal like this, so who knows.

Realistically its like someone buying out Ford to turn them all into electric econoboxes. Investors are smarter than that. It would be a guaranteed trip to bankruptcy and youd literally have to be mentally retarded to not be aware of that.

This conpany doesnt have a billion dollars cash (as the offer)

Youd need big time investors.

Yes you could say Bloomy, but even he doesn’t spend more than a couple million on his gun agenda. Hed get a lot more done investing 1bn in anti gun tactics then buying out Freedom.

Not that he would do either, as they’d basically be throwing away a billion dollars, which he would be aware of.

No billionaire, whether he has 5bn or 50bn is going to throw away 1bn.

Absolutely a publicity stunt.

Thank jebus I was hopping with the new plant down south new remlins would be less crap maybe even good enough to spend money on

Comments are closed.